My Past Due Bill Is 585

Onlines

Mar 23, 2025 · 6 min read

Table of Contents

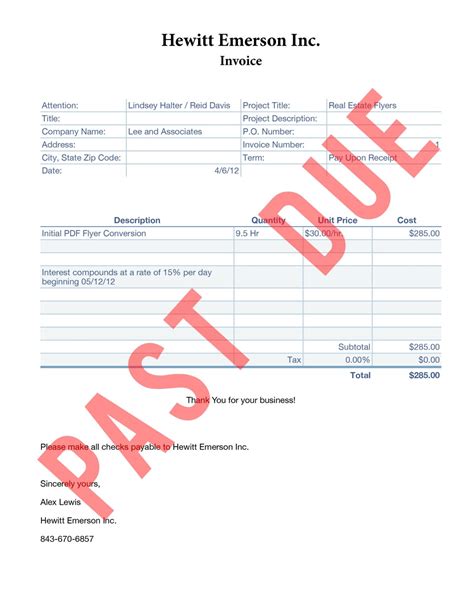

My Past Due Bill is $585: Navigating the Stress and Finding Solutions

Facing a past-due bill of $585 can be incredibly stressful. This amount is significant enough to cause worry and potentially impact your credit score and financial well-being. This comprehensive guide will help you navigate this challenging situation, offering strategies to manage the debt, prevent future occurrences, and regain control of your finances.

Understanding the Urgency: Why Addressing $585 Past Due is Crucial

Ignoring a past-due bill, regardless of the amount, is never a good idea. Here's why addressing your $585 debt immediately is crucial:

- Damage to Credit Score: Late payments are reported to credit bureaus, negatively impacting your credit score. A lower credit score can make it harder to get loans, rent an apartment, or even secure certain jobs. The impact of a $585 past-due bill can be substantial, especially if you have other late payments on your record.

- Collection Agencies: If you don't pay the bill, it might be sent to a collections agency. These agencies are aggressive in their pursuit of payment and can employ tactics that add to your stress and financial burden. Dealing with collections agencies is significantly more difficult than dealing directly with the original creditor.

- Account Suspension/Termination: Depending on the type of bill (e.g., utilities, internet, phone), your service might be suspended or terminated. This disruption can significantly impact your daily life and potentially cause further financial complications.

- Legal Action: In some cases, persistent non-payment can lead to legal action, such as lawsuits and wage garnishment. This is the most severe consequence and should be avoided at all costs.

Identifying the Source of the $585 Past Due Bill

Before devising a solution, determine the source of the debt. This will dictate your approach to resolving the issue. Common sources include:

- Credit Card Debt: High interest rates and minimum payments can quickly lead to mounting debt.

- Medical Bills: Unexpected medical expenses are a significant source of financial strain for many individuals.

- Utility Bills: Electricity, water, gas, and internet bills can accumulate quickly if not managed properly.

- Loan Repayments: Missed payments on personal loans, student loans, or car loans can result in past-due balances.

- Other Expenses: Missed payments on rent, subscriptions, or other recurring expenses can all contribute to a past-due balance.

Strategies for Addressing Your $585 Past Due Bill

The best approach depends on your specific circumstances and the creditor's policies. Here's a breakdown of effective strategies:

1. Contact the Creditor Immediately:

This is the single most important step. Don't avoid communication. Explain your situation honestly and respectfully. Many creditors are willing to work with you if you demonstrate a genuine effort to resolve the debt.

- Negotiate a Payment Plan: Request a payment plan that breaks down the $585 into smaller, more manageable installments. Be clear about how much you can realistically afford to pay each month.

- Request a Reduction of Fees: Late fees and interest can quickly inflate your debt. Politely ask for a reduction or waiver of these fees.

- Explore Hardship Programs: Some creditors offer hardship programs to help individuals facing financial difficulties. These programs might provide temporary reductions in payments or interest rates.

2. Budget and Prioritize:

Create a detailed budget to track your income and expenses. Identify areas where you can cut back to free up funds for debt repayment. Prioritize essential expenses (housing, food, transportation, medications) and allocate funds towards your $585 debt repayment.

- Track Every Penny: Use budgeting apps, spreadsheets, or notebooks to monitor your spending habits meticulously.

- Reduce Non-Essential Expenses: Identify non-essential expenses (e.g., entertainment, dining out, subscriptions) and cut them back or eliminate them entirely.

- Explore Side Hustles: Consider taking on a part-time job, freelancing, or selling unwanted items to generate extra income for debt repayment.

3. Seek Professional Financial Advice:

If you're struggling to manage your finances and debt on your own, consider seeking help from a financial advisor or credit counselor. They can provide personalized guidance, create a debt management plan, and negotiate with creditors on your behalf.

- Non-Profit Credit Counseling Agencies: These agencies offer free or low-cost services to help individuals manage their debt. They can help you create a budget and negotiate with creditors to lower interest rates and fees.

- Financial Advisors: Financial advisors can provide more personalized advice and guidance on managing your finances and debt.

4. Consider Debt Consolidation:

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially reduce the total amount you owe over time. However, it's essential to research different options carefully and choose a consolidation loan with favorable terms.

- Balance Transfer Credit Cards: If you have good credit, a balance transfer credit card can offer a 0% introductory APR for a specific period, allowing you to pay down your debt without accruing interest.

5. Prevent Future Past-Due Bills:

Implementing strategies to prevent future past-due bills is just as important as addressing your current debt.

- Automated Payments: Set up automatic payments for your bills to ensure timely payments and avoid late fees.

- Budgeting Apps: Utilize budgeting apps to track your expenses, create a budget, and receive alerts for upcoming bills.

- Emergency Fund: Build an emergency fund to cover unexpected expenses and prevent them from becoming past-due bills.

6. Understanding the Legal Ramifications of Non-Payment:

While negotiating is the preferred route, understanding the worst-case scenarios is crucial. If you cannot afford to pay, ignoring the debt is not a solution. You risk:

- Lawsuits: Creditors can take you to court to recover the debt.

- Wage Garnishment: A court order can allow creditors to seize a portion of your wages.

- Bank Levy: Creditors can freeze your bank accounts to seize funds.

- Repossession: If the debt relates to a secured loan (like a car loan), the creditor can repossess the asset.

7. Utilizing Available Resources:

Don't hesitate to explore available resources to help manage your finances. These might include:

- Government assistance programs: Depending on your location and income, you might be eligible for government assistance programs that can help with utility bills, medical expenses, or other essential costs.

- Community support: Local charities and non-profit organizations often offer financial assistance and support to individuals in need.

8. The Importance of Open Communication:

Maintaining open communication with your creditors is key throughout the process. Be honest about your financial situation and work collaboratively to find a solution that works for both parties. A proactive approach, even if you can only afford a small payment, shows good faith and increases your chances of a favorable outcome.

Conclusion: Regaining Control of Your Finances

A $585 past-due bill is a significant financial challenge, but it's not insurmountable. By taking proactive steps, communicating effectively with your creditors, and implementing sound financial management strategies, you can overcome this obstacle and regain control of your finances. Remember that seeking help is a sign of strength, not weakness. Don't hesitate to utilize available resources and professional guidance to navigate this difficult situation successfully. The key is to act quickly, communicate honestly, and develop a plan to address the debt and prevent future financial difficulties. Your financial well-being is important, and taking control is the first step toward a brighter financial future.

Latest Posts

Latest Posts

-

Why Do Project Practitioners Use Schedule Reserves

Mar 26, 2025

-

Ftt 101 Mechanics In Firearms Quizlet

Mar 26, 2025

-

When I Look Back On The Decisions I Ve Made

Mar 26, 2025

-

Addressable Systems Commonly Use A Verification Method Called

Mar 26, 2025

-

Where Are The Materials To Be Used For Walls Found

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about My Past Due Bill Is 585 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.