Ngpf Activity Bank Types Of Credit Answer Key

Onlines

Mar 19, 2025 · 7 min read

Table of Contents

- Ngpf Activity Bank Types Of Credit Answer Key

- Table of Contents

- NGPF Activity Bank: Types of Credit Answer Key & Comprehensive Guide

- Understanding the NGPF Activity Bank: Types of Credit

- Types of Credit Explained: Unveiling the Answer Key Concepts

- 1. Credit Cards: The revolving credit king

- 2. Installment Loans: Fixed Payments for Planned Purchases

- 3. Mortgages: Financing Your Dream Home

- 4. Student Loans: Investing in Your Future

- 5. Payday Loans: Short-Term, High-Cost Borrowing

- 6. Auto Loans: Financing Your Vehicle

- Beyond the Answer Key: Mastering Credit Management

- Preparing for the NGPF Activity Bank: Tips and Strategies

- Conclusion: Embracing Financial Literacy through NGPF

- Latest Posts

- Latest Posts

- Related Post

NGPF Activity Bank: Types of Credit Answer Key & Comprehensive Guide

Navigating the world of personal finance can be daunting, especially when dealing with different types of credit. The Next Gen Personal Finance (NGPF) Activity Bank provides valuable resources to help students understand these complexities. This comprehensive guide delves into the NGPF Activity Bank's "Types of Credit" activity, offering answers, explanations, and a broader understanding of various credit options available. We'll explore the nuances of each credit type, helping you grasp the core concepts and make informed financial decisions.

Understanding the NGPF Activity Bank: Types of Credit

The NGPF Activity Bank's "Types of Credit" activity is designed to educate users on the diverse landscape of credit products. It challenges users to identify and differentiate between various credit types, analyze their features, and assess their suitability for different financial situations. This isn't just about memorizing definitions; it's about understanding the implications of each choice.

The activity likely tests your knowledge of credit types through scenarios, matching exercises, or multiple-choice questions. It aims to solidify your understanding of key concepts like interest rates, credit scores, APR (Annual Percentage Rate), and the long-term financial consequences of managing credit responsibly (or irresponsibly).

Types of Credit Explained: Unveiling the Answer Key Concepts

While a specific answer key for the NGPF Activity Bank is not publicly available (to prevent cheating and encourage learning through understanding), this guide provides detailed explanations of the core credit types you're likely to encounter in the activity. Understanding these will equip you to answer any related questions effectively.

1. Credit Cards: The revolving credit king

Credit cards are a common form of revolving credit. This means you're given a credit limit, and you can borrow up to that amount, repay a portion, and borrow again within that limit. Key features include:

- High Interest Rates: Credit cards often carry high APRs, making it crucial to pay off balances promptly to avoid accumulating significant interest charges.

- Rewards Programs: Many credit cards offer rewards like cashback, points, or miles, incentivizing responsible spending and usage. However, it’s crucial to balance the rewards with the potential interest cost.

- Annual Fees: Some credit cards charge an annual fee for the privilege of using the card.

- Credit Limit: The maximum amount you can borrow. Responsible usage involves keeping your credit utilization low (ideally under 30% of your limit).

- Importance for Credit Score: Credit card usage and repayment history significantly impact your credit score.

2. Installment Loans: Fixed Payments for Planned Purchases

Installment loans are characterized by fixed payments made over a specific period. These loans are typically used for larger purchases like cars or appliances.

- Fixed Monthly Payments: You pay the same amount each month until the loan is repaid.

- Lower Interest Rates (Often): Compared to credit cards, installment loans often have lower APRs, especially for those with good credit scores.

- Predetermined Loan Term: The length of the loan (e.g., 36 months, 60 months) is fixed at the outset.

- Examples: Auto loans, mortgages, personal loans. Each loan has different terms and conditions.

- Impact on Credit Score: Timely repayment improves your credit score. Late payments can significantly damage it.

3. Mortgages: Financing Your Dream Home

A mortgage is a long-term installment loan specifically for purchasing real estate. It's secured by the property itself, meaning the lender can seize the property if you default on payments. Key aspects include:

- Extremely Long Loan Terms: Mortgages typically span 15, 20, or 30 years.

- Variable or Fixed Rates: You can choose between a fixed-rate mortgage (consistent interest rate throughout the loan term) or an adjustable-rate mortgage (interest rate fluctuates based on market conditions).

- Down Payment: A significant upfront payment required to secure the mortgage.

- Property Taxes and Insurance: Often included in your monthly mortgage payment.

- Significant Financial Commitment: Mortgages are major financial commitments that require careful planning and consideration.

4. Student Loans: Investing in Your Future

Student loans help finance education expenses. They can be federal (government-backed) or private (from banks or other lenders). Understanding the differences is crucial.

- Federal Student Loans: Generally offer more flexible repayment options and lower interest rates compared to private loans. They also have consumer protections.

- Private Student Loans: Have varying interest rates and terms depending on the lender and your creditworthiness. May not offer the same protections as federal loans.

- Deferment and Forbearance: Options for temporarily suspending or reducing payments under certain circumstances.

- Repayment Plans: Various repayment plans are available, impacting monthly payments and overall repayment time.

- Long-Term Financial Implications: Student loans can significantly impact your financial future for years to come.

5. Payday Loans: Short-Term, High-Cost Borrowing

Payday loans are designed to be repaid on your next payday. They typically involve high fees and interest rates, making them a risky option.

- Extremely High Interest Rates: Payday loans come with exceptionally high APRs, making them a very expensive borrowing option.

- Short Repayment Period: The loan is designed to be repaid within a short timeframe, often two weeks.

- Risk of Debt Traps: The high cost and short repayment period can trap borrowers in a cycle of debt.

- Alternatives: Before resorting to payday loans, explore more affordable options like credit counseling or borrowing from friends and family.

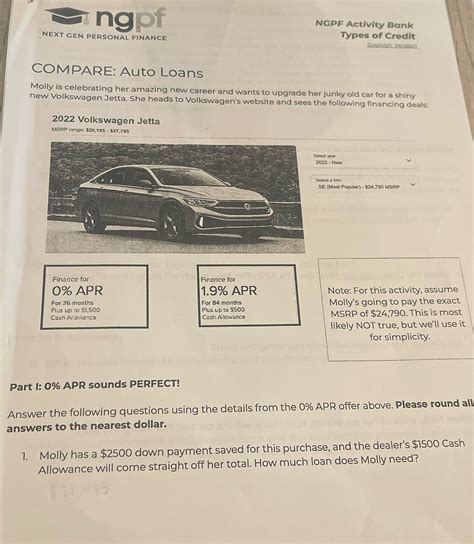

6. Auto Loans: Financing Your Vehicle

Similar to mortgages, auto loans finance the purchase of a vehicle. They are secured loans, meaning the lender can repossess the vehicle if payments are missed.

- Loan Term: Typically ranges from 36 to 72 months.

- Interest Rate: Depends on your credit score and the lender.

- Down Payment: Reduces the loan amount and may result in a lower interest rate.

- Monthly Payment: Consists of principal and interest.

- Careful Consideration: Consider the total cost of the loan, including interest, before signing.

Beyond the Answer Key: Mastering Credit Management

The NGPF Activity Bank's "Types of Credit" activity serves as a foundation for understanding the various credit options. However, true mastery extends beyond simply identifying each type. It's about understanding the implications of your credit choices. Here are some key concepts to keep in mind:

- Credit Score: Your credit score is a numerical representation of your creditworthiness. Lenders use this score to assess your risk as a borrower. Maintaining a good credit score is crucial for securing favorable interest rates on loans.

- Interest Rates: The cost of borrowing money. Lower interest rates are desirable.

- APR (Annual Percentage Rate): The annual cost of credit, expressed as a percentage. It incorporates interest and other fees.

- Debt-to-Income Ratio (DTI): The percentage of your gross monthly income that goes toward debt payments. A lower DTI is generally better.

- Credit Utilization: The percentage of your available credit that you're using. Keeping credit utilization low is important for maintaining a good credit score.

Preparing for the NGPF Activity Bank: Tips and Strategies

To succeed in the NGPF Activity Bank's "Types of Credit" section, consider the following strategies:

- Thorough Reading: Carefully read the descriptions and details of each credit type provided in the activity materials.

- Note-Taking: Summarize the key characteristics of each credit type.

- Real-World Examples: Connect the theoretical concepts to real-world scenarios. Think about how you might use each type of credit in your own life.

- Practice Questions: If the activity provides practice questions, utilize them effectively to reinforce your understanding.

- Seek Clarification: Don't hesitate to ask for help or clarification if you encounter any difficulties. Utilize available resources and engage in discussions to solidify your comprehension.

Conclusion: Embracing Financial Literacy through NGPF

The NGPF Activity Bank's "Types of Credit" activity is an excellent tool for enhancing your financial literacy. By thoroughly understanding the different types of credit and their implications, you can make informed decisions that contribute to long-term financial well-being. Remember, responsible credit management is a key component of achieving your financial goals. This guide serves as a powerful resource to navigate the complexities of credit and make the most of the NGPF learning experience. Use this knowledge to build a solid financial foundation for your future.

Latest Posts

Latest Posts

-

Parsons Tripartite Model For Vocational Direction

Mar 20, 2025

-

Which Of The Following Are Considered Voip Endpoints

Mar 20, 2025

-

Which Type Of Statements May Indicate The Presence Of Depression

Mar 20, 2025

-

Algebra 3 4 Unit 6 13 Logs And Exponents

Mar 20, 2025

-

Activity 3 2 2 Dna Sentence Strips

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Ngpf Activity Bank Types Of Credit Answer Key . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.