On July 1 A Company Receives An Invoice For $800

Onlines

Mar 05, 2025 · 6 min read

Table of Contents

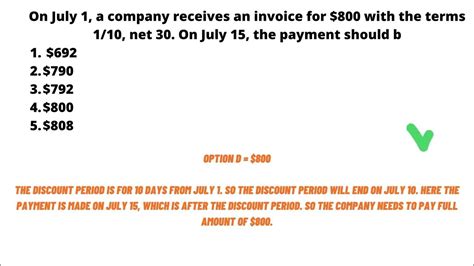

On July 1st, a Company Receives an Invoice for $800: A Deep Dive into Accounting and Financial Management

On July 1st, a seemingly simple event occurred: a company received an invoice for $800. While this might seem insignificant at first glance, this transaction triggers a cascade of accounting processes and has significant implications for the company's financial health. Let's delve into the details, exploring the accounting treatment, potential impacts, and best practices for managing such invoices effectively.

Understanding the Invoice: A Closer Look

The $800 invoice represents a liability for the company. This means it's a financial obligation the company owes to its supplier or vendor. Crucially, the invoice details matter. Key information to examine includes:

- Invoice Number: A unique identifier for the specific transaction.

- Invoice Date: July 1st, in this case. This date is critical for establishing the timing of the transaction and determining when payment is due.

- Due Date: The date by which payment must be made to avoid late payment penalties. This is usually clearly stated on the invoice.

- Description of Goods or Services: A detailed description of what the $800 covers. This could range from raw materials to consulting services. The level of detail is important for accurate expense categorization.

- Supplier Information: Contact details of the vendor issuing the invoice. This allows for easy communication and query resolution.

- Payment Terms: Specifies the payment method (e.g., check, electronic transfer) and any discounts for early payment.

Accounting Treatment: The Double-Entry System

The core principle of accounting is the double-entry bookkeeping system. Every transaction affects at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) always balances. The receipt of the $800 invoice necessitates journal entries. The exact entries depend on whether the goods or services have been received:

Scenario 1: Goods or services have been received.

In this scenario, the company incurs an expense and creates a liability (accounts payable). The journal entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Expenses (e.g., Supplies) | $800 | |

| Accounts Payable | $800 |

- Debit: Increases expense accounts. Expenses are a debit balance account.

- Credit: Increases liability accounts. Liabilities are credit balance accounts.

Scenario 2: Goods or services have not yet been received.

If the invoice is for goods or services yet to be received, a different approach is needed. The company hasn't incurred an expense yet; instead, it's a future expense. The journal entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Accrued Expenses | $800 | |

| Accounts Payable | $800 |

- Debit: Increases accrued expense account (a current liability account). This reflects the expense incurred, even though it hasn't been paid yet.

- Credit: Increases accounts payable.

Impact on Financial Statements

The $800 invoice, and the subsequent accounting entries, directly impact several key financial statements:

-

Income Statement: In Scenario 1, the $800 is recorded as an expense, reducing the company's net income for the period. In Scenario 2, no impact occurs on the income statement until the goods or services are received and the expense is recognized.

-

Balance Sheet: The $800 increases the company's liabilities (Accounts Payable or Accrued Expenses) and, depending on payment terms, may impact the company's cash balance upon payment. A higher liability would decrease the company's net worth for the current period.

-

Cash Flow Statement: The actual cash payment for the invoice will reduce the company's cash balance, affecting the operating activities section of the cash flow statement.

Best Practices for Invoice Management

Effective invoice management is crucial for maintaining accurate financial records and ensuring timely payments. Key best practices include:

-

Prompt Invoice Processing: Designate a responsible individual or department to handle incoming invoices promptly. Delay can lead to late payment fees and damaged supplier relationships.

-

Three-Way Matching: Verify the invoice against the purchase order and the goods received note (GRN) to ensure accuracy before payment. This process minimizes errors and fraudulent invoices.

-

Invoice Approval Workflow: Establish a clear approval process for invoices exceeding a certain threshold. This ensures that only authorized personnel approve payments.

-

Automated Invoice Processing: Consider implementing an automated invoice processing system (often part of accounting software). This can streamline the entire process, reducing manual effort and the risk of errors.

-

Centralized Invoice Repository: Store all invoices in a centralized, easily accessible location, either physical or digital, to ensure quick retrieval and audit trail.

-

Regular Reconciliation: Regularly reconcile accounts payable with vendor statements to identify and resolve discrepancies promptly.

-

Negotiating Payment Terms: Explore options to negotiate favorable payment terms with vendors, such as early payment discounts or extended payment deadlines, improving cash flow management.

Analyzing the $800 Invoice in a Wider Business Context

The simple $800 invoice provides a microcosm of a company's financial operations. Its proper handling reveals a lot about the company's financial health and operational efficiency. Analyzing the invoice beyond the basic accounting treatment can uncover several insightful points:

-

Cost Control: Does the $800 reflect a reasonable expense for the goods or services received? Analyzing spending patterns over time is crucial for identifying areas for cost reduction. Regular cost analyses can potentially identify inefficiencies or areas for supplier negotiation.

-

Vendor Relationships: The way the company handles the invoice (timely payment, communication with the vendor) affects its relationship with its suppliers. Maintaining positive vendor relations can unlock benefits like discounts and preferential treatment.

-

Cash Flow Management: The timing of the payment significantly impacts the company's cash flow. Proactive cash flow management is crucial for avoiding late payment fees and maintaining healthy liquidity. Predictive cash flow modeling becomes essential for ensuring enough cash to cover future liabilities.

-

Internal Controls: How the company processes the invoice demonstrates the effectiveness of its internal controls. Robust internal controls reduce the risk of fraud and errors in financial reporting.

-

Compliance: Ensuring accurate recording and timely payment of the invoice is crucial for compliance with accounting standards and tax regulations.

Conclusion: Beyond the Numbers

While the $800 invoice might seem insignificant in isolation, its careful handling demonstrates the company's commitment to sound financial management. From accurate bookkeeping and timely payments to proactive cash flow management and strong vendor relationships, every aspect of processing this invoice affects the company's overall financial health and operational efficiency. By following best practices and analyzing the implications of every financial transaction, a business can ensure its long-term success and sustainability. Treating even seemingly small invoices with the appropriate care is foundational to building a reliable and thriving enterprise. The $800 invoice is not just a number; it's a vital component of the company's financial story.

Latest Posts

Latest Posts

-

Section 3 Topic 3 Adding And Subtracting Functions

Mar 05, 2025

-

Julieta Y Cesar Ser Paramedicos

Mar 05, 2025

-

Which Of These Rhetorical Devices Is Most Clearly Used Here

Mar 05, 2025

-

Tessa Is Processing Payroll Data That Includes

Mar 05, 2025

-

By Any Other Name Questions And Answers Pdf

Mar 05, 2025

Related Post

Thank you for visiting our website which covers about On July 1 A Company Receives An Invoice For $800 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.