Ron Has A Life Insurance Policy

Onlines

Mar 28, 2025 · 7 min read

Table of Contents

Ron Has a Life Insurance Policy: A Comprehensive Guide to Understanding Its Implications

Ron has a life insurance policy. This seemingly simple statement opens a door to a complex world of financial planning, estate management, and risk mitigation. Understanding the implications of Ron's life insurance policy requires delving into several key aspects, from the type of policy he holds to the potential tax consequences and the beneficiaries designated. This comprehensive guide will explore these facets and more, providing a clear picture of the multifaceted nature of life insurance and its impact on Ron's financial future.

Understanding the Different Types of Life Insurance

Before we delve into the specifics of Ron's policy, it's crucial to understand the various types of life insurance available. This will help contextualize the potential implications of his specific policy. The two main categories are:

1. Term Life Insurance: Temporary Coverage

Term life insurance provides coverage for a specific period, or "term," such as 10, 20, or 30 years. If Ron has a term life insurance policy, his coverage will expire at the end of the term unless he renews it, which often comes with higher premiums due to his increased age. The key advantage is the affordability, making it a popular choice for younger individuals or those with specific short-term needs, like covering a mortgage. The drawback is the lack of permanent coverage. Once the term expires, the policy ends, leaving Ron without life insurance protection unless he secures a new policy.

2. Permanent Life Insurance: Lifelong Coverage

Permanent life insurance, unlike term insurance, offers lifelong coverage. There are several types of permanent life insurance, each with its own characteristics:

-

Whole Life Insurance: This provides lifelong coverage and builds cash value that grows tax-deferred. The premiums are typically higher than term life insurance, but the cash value can be borrowed against or withdrawn. This offers flexibility for Ron, allowing him to access funds for emergencies or other needs.

-

Universal Life Insurance: This type of permanent life insurance offers flexibility in premium payments and death benefit amounts. Ron can adjust his premiums within certain limits, making it adaptable to changing financial circumstances. However, it's crucial to understand the underlying investment components and potential risks involved.

-

Variable Life Insurance: Similar to universal life, variable life insurance allows for premium adjustments. However, the cash value grows based on the performance of underlying investments, introducing market risk. Ron needs to be comfortable with the investment aspect and associated volatility.

-

Variable Universal Life Insurance: This combines features of both universal and variable life insurance, offering flexibility in premiums and investment choices. It's a complex product requiring a thorough understanding of its intricacies.

Knowing the type of life insurance Ron possesses is critical in understanding the financial implications for him and his beneficiaries.

Analyzing Ron's Life Insurance Policy Details

To truly understand the implications of Ron's policy, we need to consider several key details:

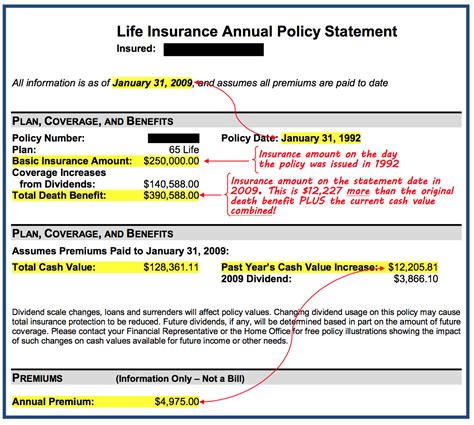

1. Death Benefit: The Core of the Policy

The death benefit is the amount paid to the beneficiaries upon Ron's death. This amount can significantly impact the financial well-being of his family. A higher death benefit offers greater financial security, but it also usually comes with higher premiums. The amount should be sufficient to cover outstanding debts, provide for ongoing living expenses for dependents, fund children's education, and ensure overall financial stability.

2. Premium Payments: The Cost of Coverage

The premium is the regular payment Ron makes to maintain his life insurance coverage. Understanding the payment schedule (monthly, annually, etc.) and the total cost over the policy's duration is crucial. High premiums might necessitate adjustments to Ron's budget. Analyzing premium trends and potential increases is also important for long-term financial planning.

3. Cash Value (If Applicable): A Built-in Savings Element

Some life insurance policies, like whole life insurance, build cash value over time. This cash value can be accessed through loans or withdrawals, providing Ron with a source of funds in times of need. However, borrowing against the cash value reduces the death benefit and may incur interest charges. Understanding how the cash value grows and the potential tax implications of accessing it is crucial.

4. Beneficiaries: Who Receives the Death Benefit?

The beneficiaries are the individuals or entities designated to receive the death benefit upon Ron's death. Clearly defining the beneficiaries is vital to ensure the funds are distributed according to Ron's wishes. This might involve a spouse, children, other family members, or even a trust. Regularly reviewing and updating beneficiary designations is crucial as life circumstances change.

5. Policy Riders: Adding Extra Coverage

Many life insurance policies allow for the addition of riders, which provide extra coverage or benefits. Common riders include:

- Accidental Death Benefit Rider: Pays an additional amount if death is due to an accident.

- Disability Waiver of Premium Rider: Waives premiums if Ron becomes disabled.

- Long-Term Care Rider: Provides funds for long-term care expenses.

Understanding which riders Ron has attached to his policy will provide a more accurate assessment of its overall benefits and financial implications.

Tax Implications of Ron's Life Insurance Policy

The tax implications of Ron's life insurance policy can be significant. The treatment of death benefits and cash value withdrawals varies depending on several factors, including the type of policy and how the funds are accessed:

-

Death Benefits: Generally, death benefits paid to beneficiaries are tax-free. This is a significant advantage of life insurance.

-

Cash Value Withdrawals: Withdrawals from cash value may be taxed as ordinary income, depending on the policy type and the amount withdrawn. Consult a tax professional for specific guidance on the tax treatment of cash value withdrawals.

Understanding the tax implications is crucial for proper financial planning and to avoid unforeseen tax liabilities.

Reviewing and Updating Ron's Life Insurance Policy

Regularly reviewing and updating Ron's life insurance policy is essential to ensure it continues to meet his evolving needs. Factors that may necessitate a policy review include:

-

Changes in Family Status: Marriage, divorce, birth of a child, or the death of a beneficiary can necessitate changes to the beneficiary designations and coverage amount.

-

Changes in Financial Circumstances: Significant changes in income, debt levels, or assets may require adjustments to the policy's coverage amount or premium payments.

-

Changes in Health: Major health changes may affect Ron's insurability, potentially making it more difficult or expensive to maintain or increase his coverage.

-

Changes in the Insurance Market: Changes in interest rates, investment performance, or insurance regulations can impact the value and cost of the policy.

Proactive policy reviews ensure that Ron's life insurance remains a valuable asset, providing the appropriate level of protection for his loved ones and meeting his evolving financial needs.

The Importance of Professional Advice

Navigating the complexities of life insurance can be challenging. Seeking professional advice from a qualified financial advisor or insurance agent is highly recommended. They can help Ron:

-

Choose the right type of policy: They can help determine the most suitable type of policy based on Ron's individual needs and financial circumstances.

-

Determine the appropriate coverage amount: They can assist in calculating the appropriate death benefit to meet Ron's family's financial needs.

-

Understand the policy details: They can explain the complex terms and conditions of the policy in a clear and understandable manner.

-

Develop a comprehensive financial plan: They can integrate the life insurance policy into a broader financial plan that addresses Ron's overall financial goals.

-

Manage the policy effectively: They can offer guidance on premium payments, cash value management, and beneficiary designations.

Ron's life insurance policy is a crucial component of his overall financial plan. By understanding its intricacies, regularly reviewing it, and seeking professional advice, Ron can ensure that his policy effectively protects his loved ones and secures their financial future. This comprehensive guide aims to empower Ron and others in similar situations to make informed decisions about their life insurance, understanding the complexities involved and taking control of their financial well-being.

Latest Posts

Latest Posts

-

What Would Occur If An Unfocused Slide Image Was Downloaded

Mar 31, 2025

-

The Thematic Focus Of Nehemiah Is Rebuilding The Temple

Mar 31, 2025

-

Everything I Never Told You Characters

Mar 31, 2025

-

2 13 Unit Test More Function Types

Mar 31, 2025

-

Chapter 12 Summary Of Things Fall Apart

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Ron Has A Life Insurance Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.