The Debt Snowball Worksheet Answers Pdf

Onlines

Mar 28, 2025 · 7 min read

Table of Contents

The Debt Snowball Worksheet: Answers, Strategies, and Your Path to Financial Freedom

Are you drowning in debt? Feeling overwhelmed by credit card bills, loans, and other financial obligations? You're not alone. Millions struggle with debt, but the good news is that there's a proven method to conquer it: the debt snowball method. This comprehensive guide will delve into the debt snowball worksheet, providing answers to your questions, offering strategic advice, and empowering you to finally break free from the shackles of debt.

Understanding the Debt Snowball Method

The debt snowball method, popularized by Dave Ramsey, focuses on paying off your debts in order of smallest balance to largest, regardless of interest rate. While the avalanche method (paying off highest interest debts first) might save you money on interest in the long run, the snowball method leverages the psychological power of quick wins.

Why the snowball works:

- Motivation: Seeing small debts disappear quickly provides a powerful motivational boost. This early success fuels your momentum and keeps you engaged in the process.

- Momentum: Each paid-off debt generates a surge of confidence and provides extra funds to attack the next debt on your list.

- Simplicity: The simplicity of the method makes it easy to understand and implement, even for those who are new to personal finance.

However, it's important to acknowledge that this method might not be the most mathematically efficient. Let's explore how a debt snowball worksheet can help you implement this strategy effectively.

The Debt Snowball Worksheet: A Step-by-Step Guide

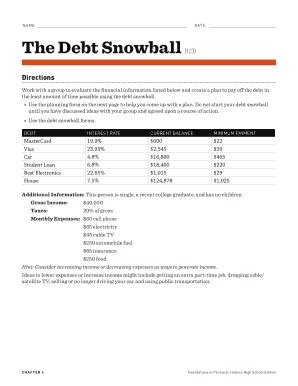

A debt snowball worksheet is a powerful tool for organizing your debts and tracking your progress. It provides a clear visual representation of your financial situation, allowing you to strategize and stay motivated throughout your debt repayment journey. While you won't find a single, universally accepted "Debt Snowball Worksheet Answers PDF," because your debts are unique to you, we can outline the essential components of a highly effective worksheet.

1. List all your debts: This includes credit cards, personal loans, student loans, medical bills, and any other outstanding debts.

2. List the creditor: Note the name of each lender for each debt. This helps keep your records organized.

3. List the current balance: Record the current balance for each debt. This is crucial for tracking your progress.

4. List the minimum monthly payment: Note the minimum amount you're required to pay each month on each debt.

5. List the interest rate: This is crucial for understanding the overall cost of your debts. Remember, while this is NOT used to order your debts in a snowball method, it's good to note this as a point of comparison.

6. Order your debts by balance: This is the core of the snowball method. List your debts from smallest to largest balance, regardless of interest rate.

7. Create a payment plan: This is where the real work begins. You'll need to allocate extra funds to your smallest debt to accelerate its payoff. For now, continue making minimum payments on all other debts.

8. Track your progress: Regularly update your worksheet to reflect your progress. This visual tracking will reinforce your accomplishments and motivate you to continue.

Example Debt Snowball Worksheet

Let's illustrate with an example:

| Creditor | Balance | Minimum Payment | Interest Rate | Order |

|---|---|---|---|---|

| Medical Bill | $500 | $50 | 0% | 1 |

| Credit Card 1 | $800 | $25 | 18% | 2 |

| Credit Card 2 | $1,200 | $40 | 21% | 3 |

| Personal Loan | $5,000 | $150 | 7% | 4 |

| Student Loan | $20,000 | $300 | 5% | 5 |

In this example, you would focus on paying off the medical bill first, then credit card 1, and so on. Remember, you're making minimum payments on all other debts while aggressively paying down the smallest debt.

Advanced Strategies and Considerations

While the basic debt snowball worksheet is straightforward, there are several advanced strategies you can employ to accelerate your progress:

- Increase your income: Explore ways to boost your income, such as taking on a side hustle, negotiating a raise, or selling unused assets. Every extra dollar goes directly towards your debt payoff.

- Reduce your expenses: Carefully examine your spending habits and identify areas where you can cut back. Even small reductions can make a significant impact over time.

- Negotiate with creditors: In some cases, you may be able to negotiate lower interest rates or payment plans with your creditors.

- Debt consolidation: Consider consolidating your debts into a single loan with a lower interest rate. This can simplify your payments and potentially reduce your overall interest costs. However, this is a crucial decision and should be carefully considered.

- Seek professional help: If you're struggling to manage your debts, consider seeking professional help from a financial advisor or credit counselor.

Beyond the Worksheet: Maintaining Momentum and Achieving Financial Freedom

The debt snowball worksheet is a valuable tool, but its effectiveness relies on your commitment and consistency. Here's how to maintain momentum:

- Celebrate your wins: Acknowledge and celebrate each debt you pay off. Reward yourself (within reason!) to reinforce your progress and stay motivated.

- Visualize your success: Keep your debt snowball worksheet prominently displayed as a constant reminder of your progress and your financial goals.

- Stay focused on your goal: Remember your "why." Why are you working so hard to pay off your debt? Keeping this motivation in mind will help you overcome setbacks and stay committed to the process.

- Build an emergency fund: Once you've become debt-free, a critical next step is building an emergency fund to prevent future debt accumulation. This fund should cover 3-6 months of living expenses.

FAQ: Answering Your Debt Snowball Questions

Q: What if I have multiple debts with the same balance?

A: If you have multiple debts with the same balance, prioritize the one with the highest interest rate. While still not using interest rate to determine the order like the Avalanche method, this allows you to potentially save on interest and get slightly more efficient with your money.

Q: What if my income fluctuates?

A: If your income fluctuates, you may need to adjust your payment plan accordingly. Focus on making the minimum payments on all debts during low-income periods and aggressively attacking the debt snowball during high-income periods.

Q: Can I use a debt snowball with secured debts like a mortgage?

A: While technically possible, it is generally not recommended to include secured debts such as a mortgage or auto loan in your debt snowball. These debts often have lower interest rates, and the long repayment terms may demotivate you. Prioritize high-interest unsecured debts first.

Q: Is there a debt snowball calculator?

A: While dedicated "debt snowball calculators" aren't commonly available as single software packages, many personal finance websites and budgeting apps have features that will allow you to input your debt information and project potential repayment timelines. You can easily build your own spreadsheet to simulate a debt snowball calculator with the relevant formulas.

Q: What if I miss a payment?

A: Missing a payment can have negative consequences. Do your best to avoid this by budgeting effectively and communicating with your creditors if you anticipate difficulties. Late payments can impact your credit score.

Q: How long will the debt snowball take?

A: The time it takes to pay off your debt using the snowball method varies greatly depending on your income, expenses, debt amounts, and the aggressiveness of your repayment strategy. There's no one-size-fits-all answer. Consistency and persistence are key.

Conclusion: Your Journey to Financial Freedom Starts Now

The debt snowball method, coupled with a well-maintained debt snowball worksheet, provides a powerful framework for conquering your debt. While a PDF containing pre-filled "answers" doesn't exist, because your financial situation is unique, the principles outlined in this guide are timeless and universally applicable. Remember, the key to success lies not just in the method itself, but in your dedication, discipline, and unwavering commitment to achieving financial freedom. By combining strategic planning with consistent action, you can transform your financial life and build a brighter future. Start your debt snowball journey today, and witness the transformative power of financial independence.

Latest Posts

Latest Posts

-

Art Labeling Activity Structure Of Long Bones

Mar 31, 2025

-

On The Equality Of The Sexes

Mar 31, 2025

-

A Sample Of A Mixture Containing An Unknown Hydrocarbon

Mar 31, 2025

-

Which Sentence Best Paraphrases The Passage

Mar 31, 2025

-

5 1 8 Configure Network Security Appliance Access

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Debt Snowball Worksheet Answers Pdf . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.