The Interest Rate A Company Pays On 1-year 5-year

Onlines

Mar 19, 2025 · 6 min read

Table of Contents

Decoding Corporate Interest Rates: A Deep Dive into 1-Year and 5-Year Borrowing Costs

Understanding the interest rates a company pays on its debt is crucial for investors, analysts, and the companies themselves. These rates, reflecting the cost of borrowing, significantly impact a company's profitability and financial health. This article delves into the intricacies of 1-year and 5-year interest rates for corporations, exploring the factors that influence them and the implications for business decisions.

What Determines Corporate Interest Rates?

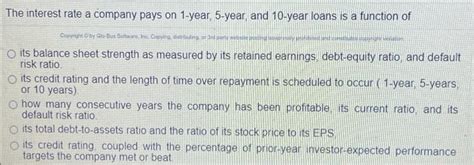

Several key factors interplay to determine the interest rate a company pays on its debt, regardless of the loan term (1-year or 5-year). These factors can be broadly categorized as:

1. Creditworthiness and Credit Rating:

The foundation of any interest rate is the borrower's creditworthiness. Companies with strong credit ratings (like AAA or AA from agencies like Moody's, S&P, and Fitch) are considered low-risk borrowers and thus secure lower interest rates. Conversely, companies with weaker credit ratings (BB, B, or below) are seen as higher-risk and must pay significantly higher rates to compensate lenders for the increased default risk. This is a fundamental principle of lending.

2. Market Interest Rates (Benchmark Rates):

Benchmark interest rates, such as the federal funds rate (in the US) or the LIBOR (London Interbank Offered Rate, although its use is phasing out and being replaced by SOFR – Secured Overnight Financing Rate), serve as a baseline for corporate borrowing rates. When these benchmark rates rise, corporate borrowing costs generally increase, and vice versa. This correlation is strong, though not always perfectly linear.

3. Term to Maturity:

The length of the loan (1-year vs. 5-year) significantly impacts the interest rate. Longer-term loans generally carry higher interest rates than shorter-term loans. This is because lenders demand a premium for tying up their capital for a longer period, exposing themselves to greater uncertainty and potential changes in market conditions. The yield curve, which plots the relationship between interest rates and maturities, illustrates this relationship. A normal yield curve slopes upward, indicating that longer-term rates are higher than shorter-term rates.

4. Collateral and Security:

The presence of collateral (assets pledged as security for the loan) can influence the interest rate. Loans secured by collateral, such as real estate or equipment, typically command lower interest rates because the lender has a claim on specific assets in case of default. Unsecured loans, on the other hand, carry higher interest rates due to the increased risk for the lender.

5. Market Conditions and Economic Outlook:

Broader economic conditions significantly impact corporate borrowing costs. During periods of economic uncertainty or recession, interest rates tend to rise as lenders become more risk-averse. Conversely, during periods of economic expansion and stability, interest rates may fall. Inflation also plays a crucial role; higher inflation often leads to higher interest rates to maintain purchasing power.

6. Company Size and Industry:

A company's size and the industry it operates in can influence interest rates. Larger, more established companies often have greater negotiating power and may secure more favorable terms. Similarly, industries perceived as less risky (e.g., utilities) might obtain lower interest rates compared to high-risk sectors (e.g., technology startups). This reflects the inherent risk profile of different business activities.

7. Loan Structure and Covenants:

The structure of the loan itself, including covenants (conditions imposed by the lender), affects the interest rate. Loans with stricter covenants (e.g., limitations on debt levels or dividend payments) might offer lower rates, reflecting the reduced risk for the lender. The complexity of the loan structure can also influence the interest rate.

1-Year vs. 5-Year Interest Rates: A Comparative Analysis

The key difference between 1-year and 5-year interest rates lies in their maturity and associated risk. A 1-year loan exposes the lender to less risk compared to a 5-year loan. However, this lower risk comes at the cost of lower potential returns for the lender.

1-Year Interest Rates: These rates are highly sensitive to short-term changes in the market. They are influenced by current benchmark rates, the company's immediate creditworthiness, and prevailing economic conditions. Companies might favor 1-year loans for short-term projects or to manage liquidity needs. The interest rate is typically reviewed annually, offering flexibility for both borrower and lender.

5-Year Interest Rates: These rates reflect a longer-term view of the company's creditworthiness and the economic outlook. They incorporate a risk premium for the extended maturity period. While offering stability in terms of predictable payments for five years, the interest rate may be slightly higher than the corresponding 1-year rate. Companies might choose 5-year loans for long-term investments or capital expenditures. The longer duration provides planning certainty but involves committing to the agreed-upon interest rate for a longer period.

Implications for Corporate Decision-Making

The choice between 1-year and 5-year loans profoundly impacts a company's financial strategy and operations.

Factors to Consider:

- Interest Rate Outlook: If a company anticipates interest rates to rise, a 1-year loan might be preferable to lock in a lower rate before rates increase. Conversely, if rates are expected to fall, a longer-term loan could be advantageous.

- Cash Flow Projections: A company’s ability to comfortably manage debt repayments is vital. A 5-year loan necessitates consistent cash flow to service debt over a longer period.

- Funding Needs: Short-term projects benefit from short-term debt; long-term investments often necessitate long-term financing.

- Risk Tolerance: Companies with high risk tolerance might favor short-term debt to maintain flexibility, while more conservative companies might opt for long-term debt for stability.

- Financial Flexibility: 1-year loans provide greater flexibility in terms of refinancing and rate adjustments. However, this comes at the cost of frequent refinancing, which can increase administrative burden and uncertainty.

Conclusion: Navigating the Interest Rate Landscape

Understanding the factors influencing corporate interest rates, specifically the nuances between 1-year and 5-year borrowing, is crucial for sound financial decision-making. Companies must carefully analyze their financial position, credit rating, projected cash flows, and future interest rate expectations to choose the borrowing strategy that best aligns with their goals and risk tolerance. The interplay between creditworthiness, market conditions, and loan structure ultimately determines the cost of capital, shaping a company's financial health and long-term success. This informed approach allows businesses to secure funding at optimal rates, optimizing their financial performance and contributing to sustainable growth. Regular monitoring of market interest rates and proactive financial planning are essential for navigating the ever-evolving landscape of corporate borrowing costs.

Latest Posts

Latest Posts

-

Which Of The Following Best Describes The Graph Below

Mar 19, 2025

-

Transport In Cells Pogil Answer Key

Mar 19, 2025

-

Signing Naturally 3 7 Identify And Draw Answers

Mar 19, 2025

-

Post Test The Early And Mid Nineteenth Century Romanticism

Mar 19, 2025

-

Nystrom Atlas Of World History Worksheets Answer Key Pdf

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Interest Rate A Company Pays On 1-year 5-year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.