Tina Taxpayer Makes 75000 A Year

Onlines

Mar 25, 2025 · 6 min read

Table of Contents

Tina Taxpayer Makes $75,000 a Year: A Deep Dive into Her Financial Landscape

Tina Taxpayer, a fictional yet relatable character, earns $75,000 annually. This seemingly comfortable income bracket presents a unique set of financial challenges and opportunities. This in-depth analysis explores Tina's potential financial situation, considering various factors like her location, lifestyle choices, and financial goals. We'll dissect her potential tax burden, savings strategies, investment possibilities, and overall financial well-being. Understanding Tina's scenario can offer valuable insights for anyone earning a similar income, helping them navigate their own financial journeys.

Understanding Tina's Income Bracket

A $75,000 annual salary positions Tina within a significant portion of the middle class in many developed countries. This income level allows for a comfortable lifestyle, but it also necessitates careful financial planning to achieve long-term financial security. The specific challenges and opportunities Tina faces depend heavily on several crucial factors:

Geographical Location: Cost of Living Variations

The cost of living significantly impacts Tina's financial situation. Living in a high-cost area like New York City, San Francisco, or London will dramatically alter her financial landscape compared to living in a smaller town or rural area. Rent, groceries, transportation, and healthcare costs vary widely geographically, impacting her disposable income and savings potential. Understanding the local cost of living index is crucial for assessing Tina's true financial health.

Lifestyle Choices and Spending Habits

Tina's spending habits are critical. Does she prioritize experiences over material possessions? Does she have significant debt, like student loans or credit card debt? Are there unforeseen expenses, such as caring for elderly parents or unexpected medical bills? Her lifestyle choices directly influence how much money she can save and invest. Mindful spending habits are key to building wealth at this income level.

Financial Goals and Aspirations

What are Tina's aspirations? Does she dream of owning a home, funding her children's education, or retiring comfortably? These goals dictate her financial priorities and the strategies she needs to employ. Long-term financial goals necessitate disciplined saving and investing, while short-term goals might require a different approach.

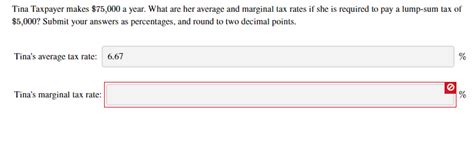

Tina's Tax Burden: A Detailed Breakdown

Understanding Tina's tax liability is vital to grasping her disposable income. This will vary significantly depending on her location (federal, state, and local taxes), filing status (single, married filing jointly, etc.), and deductions. Let's consider some general estimations, acknowledging the need for professional tax advice tailored to her specific circumstances.

Federal Income Taxes

Tina's federal income tax liability will fall within a specific tax bracket, dependent on the current tax laws in her country. She'll likely pay progressive taxes, meaning her tax rate increases as her income rises. The exact amount will be determined after accounting for standard deductions, itemized deductions (if applicable), and tax credits.

State and Local Taxes

State and local taxes further reduce Tina's net income. These vary significantly across different regions, with some states having no income tax, while others impose substantial rates. Property taxes, if she owns a home, will also contribute to her overall tax burden.

Tax Planning Strategies

Effective tax planning can help Tina minimize her tax liability legally. This includes utilizing various tax deductions and credits, such as those for retirement contributions, charitable donations, or healthcare expenses. Consulting with a tax professional is highly recommended to maximize her tax efficiency.

Savings and Investment Strategies for Tina

Saving and investing are crucial for Tina to build long-term financial security. With a $75,000 income, she has the potential to accumulate substantial wealth over time, provided she implements sound financial strategies.

Emergency Fund: The Foundation of Financial Stability

Building a robust emergency fund is paramount. This fund should cover 3-6 months of living expenses, providing a safety net in case of job loss, unexpected medical expenses, or other unforeseen events. This cushion prevents Tina from resorting to high-interest debt during emergencies.

Retirement Planning: Securing Her Future

Retirement planning is crucial. Tina should actively contribute to retirement accounts, such as a 401(k) or IRA (depending on her country's specific retirement plan options). These accounts offer tax advantages, allowing her savings to grow tax-deferred. Understanding different investment vehicles within these accounts, such as stocks, bonds, and mutual funds, is crucial for long-term growth.

Investing for Long-Term Growth

Beyond retirement accounts, Tina can explore additional investment options based on her risk tolerance and financial goals. This could involve investing in stocks, bonds, real estate, or other asset classes. Diversification is key to mitigating risk and maximizing potential returns. She should consider consulting with a financial advisor to create a personalized investment portfolio.

Debt Management: Navigating Potential Liabilities

Tina's financial well-being hinges on managing any existing debt effectively. High-interest debt, such as credit card debt, can significantly hinder her progress toward financial goals. A strategic approach to debt repayment is necessary:

Prioritizing High-Interest Debt

Tackling high-interest debt first, such as credit card debt, is crucial. Strategies like the debt avalanche (paying off the highest interest debt first) or debt snowball (paying off the smallest debt first for motivation) can be effective.

Budgeting and Expense Tracking

Careful budgeting and expense tracking are vital. Identifying areas where Tina can reduce spending without compromising her quality of life frees up resources for debt repayment and savings. Budgeting apps and tools can help automate this process.

Consolidating Debt

Debt consolidation can simplify repayment by combining multiple debts into a single loan with potentially lower interest rates. However, it’s important to carefully evaluate the terms and conditions before opting for consolidation.

Protecting Her Assets: Insurance and Estate Planning

Protecting Tina's financial assets and ensuring her family's future security are paramount. Insurance and estate planning play crucial roles in this:

Health Insurance: Mitigating Healthcare Costs

Comprehensive health insurance is vital. The cost of healthcare can be substantial, and adequate coverage protects Tina from financial ruin in case of illness or injury.

Disability Insurance: Protecting Income

Disability insurance provides income replacement if Tina becomes unable to work due to illness or injury. This safety net ensures her financial stability during a challenging period.

Life Insurance: Providing for Loved Ones

Life insurance provides financial protection for her dependents in case of her untimely death. The amount of coverage needed depends on her financial obligations and dependents.

Estate Planning: Ensuring Smooth Transition

Estate planning, including creating a will and considering trusts, ensures that her assets are distributed according to her wishes after her death, avoiding potential family disputes and legal complications.

Continuous Learning and Financial Literacy

Continuous learning is key to improving Tina’s financial literacy and making informed decisions. Accessing resources such as financial education websites, books, and seminars can greatly enhance her understanding of personal finance.

Seeking Professional Advice

Seeking advice from financial professionals, such as financial advisors and tax advisors, can provide invaluable guidance and personalized strategies tailored to her specific circumstances. A holistic approach ensures that her financial plans are aligned with her goals and risk tolerance.

Conclusion: Tina's Journey to Financial Well-being

Tina's $75,000 annual income presents both opportunities and challenges. By adopting a proactive approach to financial planning, including disciplined saving, effective debt management, strategic investing, and comprehensive insurance coverage, she can build a secure financial future. Understanding her specific circumstances—geographical location, lifestyle, and financial goals—is key to crafting a personalized strategy that maximizes her financial well-being. Remember, consulting with financial and tax professionals is crucial for tailored advice and support throughout her financial journey. The path to financial security is a continuous process of learning, adapting, and making informed decisions.

Latest Posts

Latest Posts

-

In Context The Image Of The Penny In Line 14

Mar 28, 2025

-

Abram Is A Cognitive Engineer He Develops

Mar 28, 2025

-

1 04 Quiz Applications Of Triangle Similarity

Mar 28, 2025

-

Which Of The Following Textures Is Based On Counterpoint

Mar 28, 2025

-

When I Was Puerto Rican Book Summary

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Tina Taxpayer Makes 75000 A Year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.