What Does The Allegations Process Allow The Plan To Do

Onlines

Mar 12, 2025 · 5 min read

Table of Contents

What Does the Allegations Process Allow the Plan to Do?

Navigating the complexities of employee misconduct allegations can be daunting for any organization, especially employee benefit plans governed by the Employee Retirement Income Security Act of 1974 (ERISA). Understanding the allegations process, its purpose, and the powers it grants to the plan is crucial for maintaining a compliant and ethical workplace. This article delves into the intricacies of the allegations process under ERISA, outlining what actions the plan is permitted to take, the importance of due process, and the potential legal ramifications of mishandling allegations.

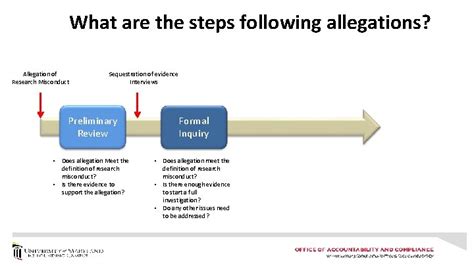

The Purpose of the Allegations Process

The primary purpose of a robust allegations process within an employee benefit plan is to protect the integrity of the plan, its assets, and its participants. This involves:

- Investigating allegations: The process provides a structured framework for thoroughly investigating any claims of misconduct, ensuring a fair and impartial examination of the facts.

- Protecting plan assets: By promptly addressing allegations of fraud, embezzlement, or other financial improprieties, the plan can safeguard its resources and prevent further losses.

- Ensuring compliance: A well-defined process helps the plan adhere to legal and regulatory requirements, minimizing the risk of penalties and legal challenges.

- Maintaining a safe and ethical work environment: Addressing allegations of harassment, discrimination, or other forms of misconduct helps foster a positive and productive workplace culture.

- Preserving the reputation of the plan: Transparent and effective handling of allegations helps maintain public trust and confidence in the plan's administration.

What Actions Does the Allegations Process Allow the Plan to Do?

The specific actions a plan can take during the allegations process depend on the nature of the allegations, the plan's governing documents, and applicable laws. However, generally, the process empowers the plan to:

1. Conduct a Thorough Investigation

This is the cornerstone of the entire process. The plan has the authority to:

- Gather evidence: This includes interviewing witnesses, reviewing documents, conducting forensic audits, and obtaining expert opinions. The scope of the investigation must be commensurate with the seriousness of the allegations.

- Preserve evidence: Appropriate measures must be taken to ensure the integrity and preservation of any collected evidence.

- Maintain confidentiality: While transparency is important, the plan must also balance this with the need to protect the privacy of individuals involved.

- Consult legal counsel: Seeking advice from experienced ERISA attorneys is crucial to ensure that the investigation is conducted legally and ethically.

2. Impose Disciplinary Actions

Depending on the findings of the investigation, the plan may be empowered to take disciplinary actions against the alleged perpetrator. These actions can range from:

- Written warnings: For minor infractions.

- Suspension without pay: For more serious allegations.

- Termination of employment: For egregious violations or repeated offenses.

- Civil penalties: In cases of fraud or other serious financial misconduct, the plan may be able to pursue civil penalties against the perpetrator. This often requires separate legal action.

Important Note: The severity of the disciplinary action should always be proportionate to the offense and supported by substantial evidence. Arbitrary or excessively harsh penalties can lead to legal challenges.

3. Recover Misappropriated Funds

If the allegations involve the misappropriation of plan assets, the plan has the authority to:

- File lawsuits: To recover stolen funds or assets.

- Cooperate with law enforcement: To aid in criminal investigations.

- Implement stricter internal controls: To prevent future instances of asset misappropriation.

4. Implement Remedial Measures

Beyond disciplinary actions, the plan may implement various remedial measures to address the root causes of the misconduct and prevent future occurrences. This might involve:

- Policy revisions: Updating internal policies and procedures to strengthen accountability and prevent similar incidents.

- Employee training: Providing education to employees on ethical conduct, compliance requirements, and the importance of reporting misconduct.

- Strengthening internal controls: Improving financial oversight and monitoring systems to detect and deter fraudulent activity.

- Independent audits: Conducting regular independent audits to assess the plan's compliance with ERISA and other applicable regulations.

5. Report to Regulatory Authorities

Depending on the nature and severity of the allegations, the plan may be legally obligated to report the matter to relevant regulatory authorities, such as the Department of Labor (DOL). Failure to report can result in significant penalties.

The Importance of Due Process

Throughout the allegations process, it is critical that the plan adheres to the principles of due process. This means that the accused individual has the right to:

- Notice of the allegations: A clear and concise statement outlining the specific allegations against them.

- Opportunity to respond: A chance to present their side of the story, provide evidence, and challenge the allegations.

- Fair and impartial investigation: An unbiased investigation conducted by a neutral party.

- Representation: The right to be represented by legal counsel or other advocates.

- Appeal process: A mechanism for appealing the outcome of the investigation if they believe it was unfair or unjust.

Failure to uphold due process can render the plan's actions invalid and lead to legal challenges, potentially resulting in costly litigation and reputational damage.

Potential Legal Ramifications of Mishandling Allegations

Mishandling allegations can have serious legal consequences for the plan and its fiduciaries. This includes:

- ERISA violations: Failure to comply with ERISA's fiduciary duty requirements can result in significant fines and penalties.

- Lawsuits by plan participants: Participants who believe they were unfairly treated or that their rights were violated can file lawsuits against the plan.

- Criminal charges: In cases involving fraud or other criminal activity, individuals involved could face criminal prosecution.

- Reputational damage: Mishandling allegations can severely damage the plan's reputation and erode trust among participants.

Conclusion

The allegations process under ERISA is a critical mechanism for protecting the integrity of employee benefit plans. By conducting thorough investigations, imposing appropriate disciplinary actions, recovering misappropriated funds, implementing remedial measures, and adhering to due process principles, plans can ensure compliance with legal requirements, maintain a safe and ethical workplace, and protect the interests of their participants. Understanding the scope of actions permitted within this process, and the legal implications of mishandling allegations, is crucial for responsible plan management. The expertise of legal counsel specializing in ERISA is highly recommended to ensure compliance and navigate the complexities of this critical area. Remember, proactive measures and a robust, well-documented process are paramount to mitigating risk and safeguarding the plan's future.

Latest Posts

Latest Posts

-

Residents Of Griffith Park And Surrounding Neighborhoods

Mar 13, 2025

-

A Customer At A Restaurant Sees That She Was Charged

Mar 13, 2025

-

What Type Of Structure Is Shown In This Figure

Mar 13, 2025

-

Identification Of Selected Anions Lab Answers

Mar 13, 2025

-

Act Three Summary Of The Crucible

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about What Does The Allegations Process Allow The Plan To Do . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.