Which Of These Events Would Be A Result Of Inflation

Onlines

Mar 23, 2025 · 5 min read

Table of Contents

Which of These Events Would Be a Result of Inflation?

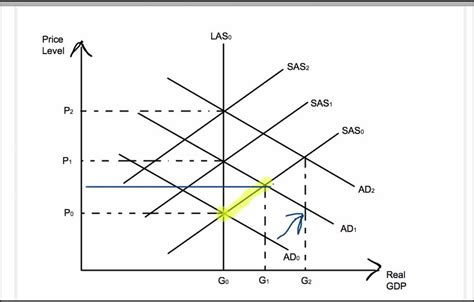

Inflation, the persistent increase in the general price level of goods and services in an economy over a period of time, is a complex economic phenomenon with far-reaching consequences. Understanding its effects is crucial for individuals, businesses, and policymakers alike. This article will explore various scenarios and determine which events are likely to be a direct result of inflation.

Understanding Inflation: A Quick Primer

Before diving into the specific events, let's establish a clear understanding of inflation. It's not simply about a few prices rising; it's about a general increase across the board. This can be driven by several factors, including:

- Demand-pull inflation: Occurs when demand for goods and services exceeds supply, leading to increased prices. Think of a popular new gadget – high demand and limited supply will drive up its price.

- Cost-push inflation: Happens when the cost of producing goods and services increases, forcing businesses to raise prices to maintain profit margins. Rising wages, increased raw material costs, or higher taxes can contribute to this.

- Built-in inflation: A self-perpetuating cycle where rising prices lead to increased wage demands, which in turn leads to further price increases. This often happens during periods of sustained inflation.

- Monetary inflation: Occurs when the money supply grows faster than the economy's output. This can be a result of government policies, such as printing more money or lowering interest rates.

Events Likely to Be a Result of Inflation

Now, let's examine some scenarios and determine whether they are likely consequences of inflation:

1. Increased Interest Rates by the Central Bank: Likely Result

Central banks often combat inflation by raising interest rates. Higher interest rates make borrowing more expensive, discouraging spending and investment, thus cooling down an overheated economy and reducing demand-pull inflation. This is a classic tool used to curb inflationary pressures.

2. Decrease in Purchasing Power: Likely Result

This is a direct and defining characteristic of inflation. When prices rise, each unit of currency buys fewer goods and services. Consequently, consumers need more money to purchase the same amount of goods they could previously afford. This erosion of purchasing power affects everyone, especially those on fixed incomes.

3. Increased Unemployment: Possible Result

While not always a direct consequence, inflation can lead to increased unemployment in certain circumstances. For example, if inflation is combated aggressively by raising interest rates, it can slow down economic growth, leading to job losses in some sectors. The relationship isn't always linear, however; some types of inflation might actually stimulate employment in certain industries.

4. Increased Savings by Households: Unlikely Result

Inflation generally discourages saving. When the value of money is declining, people are less inclined to save as their savings lose purchasing power over time. They are more likely to spend their money before it loses further value, contributing to a demand-pull inflationary spiral.

5. Decreased Investment by Businesses: Possible Result

High inflation creates uncertainty in the economy. Businesses might hesitate to invest in new projects or expansion because of unpredictable costs and fluctuating demand. High interest rates, implemented to combat inflation, further discourage investment by making borrowing expensive.

6. Increased Government Spending: Possible Result

Governments might respond to inflation by increasing spending on social programs to alleviate the burden on low-income households struggling with rising prices. However, this increased government spending, if not carefully managed, can contribute to further inflation through increased demand.

7. Increased Wages: Likely Result (but Lagging)

As prices rise, workers often demand higher wages to maintain their purchasing power. This can lead to a wage-price spiral, where rising wages further fuel price increases. However, it's important to note that wage increases often lag behind price increases, meaning that workers might experience a temporary decrease in their real income before wages adjust.

8. Decreased Exports: Possible Result

High inflation can make a country's goods and services more expensive compared to those of other countries. This can reduce the competitiveness of its exports and lead to a decrease in foreign demand. This effect is particularly pronounced if other countries don't experience similar levels of inflation.

9. Increased Imports: Possible Result

Conversely, domestic goods might become more expensive compared to imported goods, leading to increased imports. Consumers might switch to cheaper alternatives from countries with lower inflation rates.

10. Increased Stock Market Volatility: Likely Result

Inflation introduces uncertainty into the market, impacting investor confidence. Fluctuations in inflation expectations can cause increased volatility in the stock market as investors try to assess the impact on corporate earnings and future economic growth.

11. Shortage of Goods: Possible Result

While not always a direct consequence, severe inflation can lead to shortages of certain goods. This happens when increased prices, coupled with supply chain disruptions or production bottlenecks, make it difficult for businesses to meet consumer demand. Panic buying can exacerbate the problem, leading to empty shelves.

12. Menu Costs: Likely Result

This refers to the costs businesses incur to update their prices in response to changing inflation rates. These costs can range from printing new menus to updating price tags online, impacting business profitability.

Understanding the Interplay of Factors

It's crucial to understand that inflation is a complex process, and these events don't always occur in isolation. They are interconnected and can reinforce each other, creating a feedback loop. For example, increased wages can lead to further price increases, while higher interest rates can curb inflation but also potentially lead to decreased investment and higher unemployment.

The severity and specific effects of inflation also depend on its magnitude and duration. Mild, temporary inflation might have minimal impact, while hyperinflation can be devastating, leading to economic collapse and social unrest.

Conclusion: Navigating the Inflationary Landscape

Inflation is a multifaceted economic challenge with diverse and often interconnected consequences. While some events, like decreased purchasing power and potentially increased interest rates, are almost certain outcomes of inflationary pressures, others, such as increased unemployment or decreased investment, are more contingent on the specific circumstances and the government's policy response. Understanding these potential consequences is vital for individuals, businesses, and policymakers to effectively navigate the challenges and opportunities presented by inflation. By analyzing the interplay of various factors and the potential knock-on effects, a more comprehensive understanding of the inflationary landscape can be achieved. This allows for better preparedness and informed decision-making in the face of this pervasive economic phenomenon.

Latest Posts

Latest Posts

-

Which Of The Following Is An Example Of Coercive Tactics

Mar 25, 2025

-

4 4 4 Configure A Dhcp Relay Agent

Mar 25, 2025

-

No Bill Of Rights No Deal Icivics Answer Key

Mar 25, 2025

-

Based On Values In Cells B77 B81

Mar 25, 2025

-

You Witness Someone Suddenly Collapse The Person Is Unresponsive

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about Which Of These Events Would Be A Result Of Inflation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.