Which Statement Related To Bonds Is True

Onlines

Mar 24, 2025 · 6 min read

Table of Contents

- Which Statement Related To Bonds Is True

- Table of Contents

- Which Statement Related to Bonds is True? A Comprehensive Guide

- Understanding Basic Bond Terminology

- What is a Bond?

- Key Bond Characteristics:

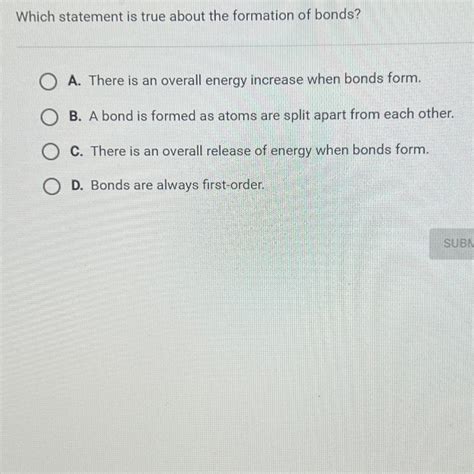

- Debunking Common Bond Myths: True or False Statements

- Advanced Bond Concepts and Considerations

- Duration and Interest Rate Sensitivity:

- Convexity:

- Callable Bonds:

- Puttable Bonds:

- Conclusion: Making Informed Bond Investment Decisions

- Latest Posts

- Latest Posts

- Related Post

Which Statement Related to Bonds is True? A Comprehensive Guide

Investing in bonds can seem daunting, especially with the plethora of information and often contradictory statements circulating. Understanding the nuances of bonds is crucial for building a diversified and successful investment portfolio. This comprehensive guide will delve into various statements related to bonds, dissecting their truthfulness and providing a clear understanding of bond mechanics. We'll explore key concepts like bond yields, credit ratings, interest rate risk, and bond diversification, equipping you with the knowledge to confidently assess bond-related claims.

Understanding Basic Bond Terminology

Before we delve into the true and false statements, let's establish a foundational understanding of some essential bond terminology.

What is a Bond?

A bond is essentially a loan you make to a government or corporation. In return for lending your money, the issuer (the government or corporation) promises to pay you back the principal (the original amount you lent) at a specified date (maturity date) and pay you periodic interest payments (coupon payments) until then.

Key Bond Characteristics:

- Issuer: The entity borrowing the money (e.g., government, corporation).

- Maturity Date: The date when the principal is repaid.

- Coupon Rate: The annual interest rate paid on the bond's face value.

- Face Value (Par Value): The amount the issuer will repay at maturity.

- Yield: The return an investor receives on a bond, considering its price and coupon payments. This can differ from the coupon rate, particularly if the bond is bought at a price different from its face value.

- Credit Rating: An assessment of the issuer's creditworthiness, indicating the likelihood of repayment.

Debunking Common Bond Myths: True or False Statements

Now let's tackle some frequently encountered statements about bonds, separating fact from fiction.

Statement 1: Bonds are always less risky than stocks.

TRUE (with qualifications). Generally, bonds are considered less risky than stocks because they offer a fixed income stream and priority in repayment during bankruptcy. However, this isn't universally true. The risk of a bond defaults (the issuer failing to repay) depends on the issuer's creditworthiness. Low-rated ("junk") bonds carry significantly higher risk than high-rated government bonds. Furthermore, interest rate risk (the risk that rising interest rates will decrease bond prices) affects all bonds, potentially leading to capital losses.

Statement 2: Bond prices and interest rates have an inverse relationship.

TRUE. This is a fundamental principle of bond investing. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. Consequently, the prices of existing bonds fall to bring their yields in line with the market. Conversely, when interest rates fall, existing bonds with higher coupon rates become more attractive, causing their prices to rise.

Statement 3: All bonds are created equal.

FALSE. Bonds vary significantly based on several factors, including:

- Issuer: Government bonds are generally considered safer than corporate bonds.

- Maturity: Shorter-term bonds are less sensitive to interest rate changes than longer-term bonds.

- Credit Rating: Higher-rated bonds carry less risk of default than lower-rated bonds.

- Coupon Rate: Bonds with higher coupon rates offer higher income but might be riskier.

Statement 4: Bond diversification reduces risk.

TRUE. Diversifying your bond portfolio across different issuers, maturities, and credit ratings can significantly reduce your overall risk. This strategy mitigates the impact of a single bond default or a change in interest rates. Similar to a diversified stock portfolio, it helps to smooth out returns and reduce volatility.

Statement 5: You can always sell a bond before maturity.

TRUE (but with potential for loss). While bonds are generally considered less liquid than stocks, you can usually sell them before their maturity date in the secondary bond market. However, the price you receive might be higher or lower than your purchase price depending on prevailing interest rates and market conditions. Selling a bond before maturity might result in a capital gain or loss depending on the prevailing market interest rates and the bond's coupon rate.

Statement 6: Bond yields always reflect the actual return.

FALSE. While the yield indicates the potential return, it doesn't account for all factors. The actual return on a bond can vary due to several factors, including:

- Reinvestment Risk: The risk that the coupon payments received cannot be reinvested at the same rate.

- Inflation: Inflation erodes the purchasing power of the bond's interest payments and principal repayment.

- Default Risk: The risk of the issuer failing to make payments.

- Call Risk (for Callable Bonds): The issuer might call the bond back before maturity, limiting your return.

Statement 7: High-yield bonds always offer high returns.

FALSE (but potentially higher returns with higher risk). High-yield bonds, also known as junk bonds, offer higher yields because they carry higher default risk. While the potential for higher returns exists, the possibility of losing your principal investment is substantially increased. The higher yield is essentially a compensation for the increased risk.

Statement 8: Bond investing is only for conservative investors.

FALSE. Bond investing can be a part of various investment strategies, catering to different risk tolerances. Conservative investors might focus on low-risk government bonds, while more aggressive investors might incorporate high-yield bonds for higher potential returns (with increased risk). A well-diversified portfolio can incorporate bonds to manage overall risk while achieving desired returns.

Statement 9: You need a large sum of money to invest in bonds.

FALSE. Many brokerage accounts allow you to purchase bonds in smaller denominations, making them accessible to investors with varying capital amounts. Bond exchange-traded funds (ETFs) also provide an affordable way to gain exposure to a diversified portfolio of bonds.

Statement 10: Bond prices are completely unaffected by market sentiment.

FALSE. While bond prices are primarily driven by interest rates and creditworthiness, market sentiment can also play a role. During periods of market uncertainty or economic downturns, investors might flock to the perceived safety of bonds, increasing demand and potentially driving prices up. Conversely, during periods of economic growth, investors might shift towards stocks, potentially reducing demand for bonds and affecting their prices.

Advanced Bond Concepts and Considerations

Understanding the basic statements is a crucial first step, but for a truly comprehensive understanding, let’s delve into some advanced concepts:

Duration and Interest Rate Sensitivity:

A bond's duration measures its sensitivity to interest rate changes. Longer-duration bonds are more sensitive to interest rate fluctuations than shorter-duration bonds. This understanding is critical for managing interest rate risk in your portfolio.

Convexity:

Convexity describes the curvature of the relationship between bond prices and interest rates. It helps refine the understanding of duration, providing a more accurate measure of interest rate risk, particularly for larger interest rate changes.

Callable Bonds:

Callable bonds allow the issuer to redeem the bond before its maturity date. This feature introduces call risk, as the investor might receive their principal back earlier than expected, potentially at a time when reinvestment options are less favorable.

Puttable Bonds:

Conversely, puttable bonds give the investor the option to sell the bond back to the issuer before maturity under specified conditions. This provides a degree of protection against potential losses in certain scenarios.

Conclusion: Making Informed Bond Investment Decisions

By understanding the nuances of bond investing, including the true and false statements we've explored, you can make more informed decisions. Remember that bond investing isn't a one-size-fits-all approach. The optimal strategy depends on your individual risk tolerance, investment goals, and overall financial plan. Diversification across various bond types, careful consideration of maturity dates and credit ratings, and a clear understanding of interest rate risk are crucial for success in this asset class. Always consult with a qualified financial advisor before making any significant investment decisions.

Latest Posts

Latest Posts

-

White House Solar Panels Teas Passage

Mar 26, 2025

-

All Of The Following Entities Regulate Variable Life Policies Except

Mar 26, 2025

-

Category Management Dashboards Are Open To Federal Employees Only

Mar 26, 2025

-

Describe The Movement Of A Paper Ship On A Wave

Mar 26, 2025

-

Shayss Rebellion In 1786 Revealed The

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Related To Bonds Is True . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.