You Market Many Different Types Of Insurance

Onlines

Mar 14, 2025 · 6 min read

Table of Contents

You Market Many Different Types of Insurance: A Comprehensive Guide to Success

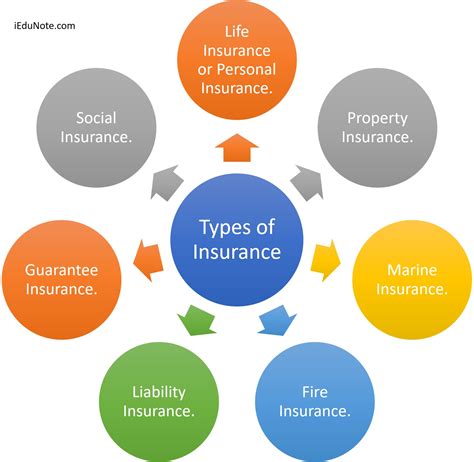

The insurance industry is vast and multifaceted, offering a wide array of products to cater to diverse needs. Successfully marketing various types of insurance requires a deep understanding of your target audiences, their specific concerns, and the unique selling propositions of each product. This comprehensive guide delves into the strategies and tactics you can employ to effectively market multiple insurance types, building a robust and successful business.

Understanding Your Target Audience: The Cornerstone of Successful Insurance Marketing

Before diving into specific marketing strategies, it's crucial to understand your target audience for each insurance product. Different insurance types attract different demographics and have different needs. For instance:

-

Life Insurance: This typically targets individuals with dependents, those looking to secure their family's financial future, or those planning for estate preservation. Marketing materials should emphasize financial security, legacy planning, and peace of mind.

-

Health Insurance: This caters to individuals and families concerned about medical expenses. Marketing should highlight coverage details, affordability, network providers, and the peace of mind that comes with having healthcare access.

-

Auto Insurance: This targets car owners, emphasizing liability protection, collision coverage, and roadside assistance. Marketing should focus on affordability, ease of claim processing, and strong customer service.

-

Home Insurance: This is essential for homeowners, protecting them from various risks like fire, theft, and natural disasters. Marketing should highlight the level of protection offered, the security it provides, and potentially add-ons like flood or earthquake insurance.

-

Commercial Insurance: This is targeted at businesses of all sizes, offering coverage for property, liability, and other business-related risks. Marketing should highlight risk mitigation, business continuity, and the potential financial losses that the insurance protects against.

-

Travel Insurance: This caters to travelers, protecting them against trip cancellations, medical emergencies, and lost luggage. Marketing should emphasize peace of mind, travel flexibility, and protection against unexpected events.

Tailoring Your Marketing Strategies: A Multi-pronged Approach

Effective marketing requires a multi-pronged approach, utilizing diverse channels and strategies to reach your target audience effectively.

1. Digital Marketing: Reaching a Wider Audience

-

Search Engine Optimization (SEO): Optimize your website and content for relevant keywords related to each insurance type. This increases your visibility in search engine results, attracting potential customers actively seeking insurance solutions. Thorough keyword research is crucial to identify the terms your target audience is using.

-

Pay-Per-Click (PPC) Advertising: Utilize targeted advertising campaigns on platforms like Google Ads to reach specific demographics interested in particular insurance products. Precisely target your campaigns to maximize ROI and avoid wasted ad spend.

-

Social Media Marketing: Engage with your target audience on platforms like Facebook, Instagram, and LinkedIn, sharing informative content, answering questions, and building brand awareness. Tailor your social media messaging to the platform and your audience.

-

Email Marketing: Build an email list of potential customers and nurture them with relevant content, special offers, and updates related to their specific insurance needs. Segment your email lists based on insurance type interest to maximize engagement.

-

Content Marketing: Create high-quality, informative blog posts, articles, infographics, and videos related to each insurance type. This establishes you as an industry expert and builds trust with potential customers. Focus on addressing common customer questions and concerns.

2. Traditional Marketing: Maintaining a Balanced Approach

While digital marketing is crucial in today's world, traditional methods still hold significance, especially when reaching certain demographics:

-

Print Advertising: Consider placing ads in relevant publications, like local newspapers or magazines, to reach your local customer base. Target publications with a readership aligned to your specific insurance product.

-

Direct Mail Marketing: Personalized mailers and brochures can be effective in reaching potential clients directly. However, carefully target your mailing list to avoid wasting resources.

-

Partnerships and Referrals: Collaborate with complementary businesses (e.g., real estate agents for home insurance, travel agencies for travel insurance) to generate referrals. Develop a mutually beneficial referral program.

3. Building Trust and Credibility: The Key to Long-Term Success

Trust is paramount in the insurance industry. Here's how to build credibility and gain customer confidence:

-

Testimonials and Case Studies: Showcase positive customer experiences to demonstrate your expertise and the value you provide. Include client testimonials on your website and in marketing materials.

-

Industry Certifications and Awards: Highlight any relevant certifications or awards to establish your expertise and professionalism. Display your certifications prominently on your website and marketing materials.

-

Strong Customer Service: Providing excellent customer support builds loyalty and encourages positive word-of-mouth marketing. Invest in training your customer service team to handle customer queries efficiently and effectively.

-

Transparency and Clear Communication: Clearly communicate your products, coverage details, and pricing to avoid any misconceptions. Maintain transparent communication throughout the customer journey.

Specific Marketing Strategies for Different Insurance Types

While the general principles mentioned above apply across the board, some strategies are particularly effective for specific insurance types:

Life Insurance:

- Focus on Legacy Planning: Emphasize the importance of securing the financial future of loved ones.

- Highlight Different Policy Types: Explain the differences between term life, whole life, and universal life insurance.

- Use Emotional Storytelling: Connect with potential clients on an emotional level, highlighting the peace of mind that life insurance provides.

Health Insurance:

- Emphasize Affordable Coverage: Highlight the cost-effectiveness of your plans and any subsidies available.

- Focus on Network Providers: Clearly communicate the list of hospitals and doctors within your network.

- Explain Coverage Details: Clearly outline the benefits and limitations of each plan.

Auto Insurance:

- Offer Competitive Pricing: Highlight your affordability compared to competitors.

- Promote Add-ons: Showcase additional benefits like roadside assistance and rental car coverage.

- Emphasize Claim Processing: Explain the ease and speed of your claims process.

Home Insurance:

- Highlight Coverage for Natural Disasters: Mention coverage for specific regional risks (e.g., earthquakes, hurricanes, floods).

- Emphasize Security Features: Highlight features like security systems and fire safety protections.

- Offer Bundling Options: Provide options for bundling home and auto insurance for discounts.

Commercial Insurance:

- Target Specific Industries: Tailor your marketing messages to the needs of specific business types.

- Focus on Risk Mitigation: Highlight how your insurance can protect businesses from potential losses.

- Emphasize Business Continuity: Show how your insurance can help businesses recover from unforeseen events.

Travel Insurance:

- Target Specific Travelers: Tailor your marketing to specific traveler profiles (e.g., families, adventure travelers, business travelers).

- Highlight Specific Coverages: Emphasize coverage for trip cancellations, medical emergencies, and lost luggage.

- Partner with Travel Agencies: Collaborate with travel agencies to offer your insurance products to their clients.

Measuring Your Success: Tracking and Analysis

Regularly track and analyze the performance of your marketing campaigns across all channels. Use analytics platforms to monitor website traffic, social media engagement, lead generation, and conversion rates. This data will help you refine your strategies, optimize your campaigns, and maximize your ROI.

Conclusion: Building a Thriving Insurance Business

Successfully marketing multiple types of insurance requires a strategic, multi-faceted approach that combines digital and traditional strategies, emphasizes building trust and credibility, and tailors messaging to specific target audiences. By consistently monitoring your performance and adapting your strategies based on data, you can build a thriving and successful insurance business. Remember that continuous learning, adaptation, and a commitment to excellence are essential for long-term success in this dynamic industry.

Latest Posts

Latest Posts

-

Plant Reproduction And Nutrient Needs Guided Notes Answers

Mar 15, 2025

-

The Rose That Grew From Concrete Theme

Mar 15, 2025

-

Forensic Science A To Z Challenge

Mar 15, 2025

-

3 3 7 Choose And Install A Motherboard

Mar 15, 2025

-

Consider The Five Networks Shown At Right

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about You Market Many Different Types Of Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.