Chapter 23 Perfect Competition Ap Econ Quizlet Mcconnell Brue

Onlines

Mar 17, 2025 · 7 min read

Table of Contents

Chapter 23: Perfect Competition - A Deep Dive into McConnell, Brue, and AP Economics

This comprehensive guide delves into Chapter 23 of McConnell, Brue's economics textbook, focusing on perfect competition within the context of AP Economics. We'll dissect the key concepts, explore real-world applications, and provide you with a solid understanding to ace your quizzes and exams. We’ll cover everything from the defining characteristics of perfect competition to its implications for resource allocation and economic efficiency. Prepare to master this crucial chapter!

Understanding Perfect Competition: The Ideal Market Structure

Perfect competition, while rarely observed in its purest form in the real world, serves as a crucial benchmark for understanding other market structures. It represents an idealized model where numerous buyers and sellers interact, creating a highly competitive environment. This competitive pressure forces firms to operate efficiently and produce at the lowest possible cost.

Defining Characteristics of Perfect Competition

Several key characteristics define perfect competition:

-

Large Number of Buyers and Sellers: No single buyer or seller can influence the market price. Each firm is too small to impact the overall market supply, and each consumer is too small to impact overall demand. This is often referred to as "price takers".

-

Homogenous Products: Products offered by different firms are identical or nearly so. Consumers see no difference between the products of one firm and another. Brand loyalty is essentially nonexistent. Think of agricultural commodities like wheat or corn.

-

Free Entry and Exit: Firms can easily enter or exit the market without significant barriers. There are no significant costs or regulations preventing new businesses from entering or existing ones from leaving. This ensures that the industry adjusts to changes in market conditions.

-

Perfect Information: Buyers and sellers have complete and accurate information about prices, products, and production costs. Transparency is paramount. Every participant in the market has access to the same information at the same time.

-

No Externalities: The production or consumption of the good does not impose costs or benefits on third parties. The market price fully reflects all the costs and benefits of production and consumption.

Implications of Perfect Competition

The characteristics of perfect competition have significant implications for firm behavior and market outcomes:

-

Price Takers: Individual firms have no control over the market price. They must accept the prevailing price as determined by the interaction of market supply and demand. Attempting to charge a higher price would result in zero sales as consumers would simply buy from other firms at the lower market price.

-

Horizontal Demand Curve: Each firm faces a perfectly elastic (horizontal) demand curve. This reflects the fact that they can sell any quantity at the market price, but no quantity at a price above it.

-

Profit Maximization: Firms aim to maximize profit by producing the quantity where marginal revenue (MR) equals marginal cost (MC). In perfect competition, MR equals the market price.

-

Zero Economic Profit in the Long Run: Due to free entry and exit, economic profits attract new firms into the market, increasing supply and driving down prices until economic profits are zero. Economic losses lead to firms exiting, decreasing supply and raising prices until economic profits are again zero. This is a crucial point for understanding long-run equilibrium.

-

Allocative and Productive Efficiency: Perfect competition leads to both allocative and productive efficiency. Allocative efficiency means that resources are allocated to produce the goods and services that society most values. Productive efficiency means that goods are produced at the lowest possible cost.

Perfect Competition vs. Other Market Structures

Understanding perfect competition requires comparing it to other market structures:

Monopoly

A monopoly is the opposite of perfect competition. It features a single seller dominating the market, allowing for price manipulation and limited consumer choice. Barriers to entry are significant, preventing competition. Monopoly firms can charge prices higher than marginal cost, resulting in deadweight loss – a reduction in overall economic efficiency.

Monopolistic Competition

Monopolistic competition involves many sellers offering differentiated products. Product differentiation allows some level of price control, but less than a monopoly. Entry and exit are relatively easy, but less so than in perfect competition. The presence of product differentiation leads to some level of inefficiency.

Oligopoly

An oligopoly consists of a few large firms that dominate the market. These firms are interdependent, meaning their actions significantly affect each other's profits. The outcome depends heavily on the strategic interactions between firms. This can result in higher prices and reduced output compared to perfect competition.

Analyzing Costs and Revenues in Perfect Competition

A deep understanding of cost and revenue curves is essential for analyzing firm behavior under perfect competition.

Total Revenue, Average Revenue, and Marginal Revenue

-

Total Revenue (TR): The total amount of money a firm receives from selling its output (Price x Quantity).

-

Average Revenue (AR): The revenue per unit of output (TR/Quantity). In perfect competition, AR equals the market price.

-

Marginal Revenue (MR): The additional revenue from selling one more unit of output. In perfect competition, MR also equals the market price.

Cost Curves

-

Total Cost (TC): The sum of fixed costs (FC) and variable costs (VC).

-

Average Total Cost (ATC): Total cost divided by the quantity of output (TC/Quantity).

-

Average Fixed Cost (AFC): Fixed costs divided by the quantity of output (FC/Quantity).

-

Average Variable Cost (AVC): Variable costs divided by the quantity of output (VC/Quantity).

-

Marginal Cost (MC): The additional cost of producing one more unit of output.

Short-Run and Long-Run Equilibrium in Perfect Competition

Understanding the short-run and long-run equilibrium is critical to grasping the dynamics of perfect competition.

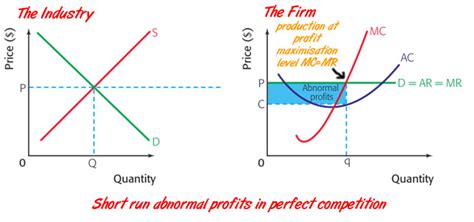

Short-Run Equilibrium

In the short run, firms can make economic profits or losses. A firm will continue to operate as long as it covers its variable costs. Profit maximization occurs where MC = MR = Price. If the market price is above the average total cost (ATC), the firm earns economic profits. If the market price is below the ATC but above the AVC, the firm incurs economic losses but continues to operate in the short run to minimize losses. If the price falls below the AVC, the firm shuts down.

Long-Run Equilibrium

In the long run, firms can adjust all their inputs, including plant size. The free entry and exit characteristic of perfect competition ensures that economic profits are driven to zero. If firms are earning economic profits, new firms enter the market, increasing supply and lowering the price until profits are eliminated. If firms are incurring economic losses, some firms exit, decreasing supply and raising the price until losses are eliminated. The long-run equilibrium occurs where MC = MR = ATC = Price. This ensures both allocative and productive efficiency.

Real-World Examples (Approximations) of Perfect Competition

While perfect competition is a theoretical model, certain markets exhibit characteristics that closely resemble it. These examples highlight the practical application of the concepts discussed:

-

Agricultural Markets: Many agricultural markets, such as wheat, corn, and soybeans, feature numerous producers selling homogeneous products. While government interventions and technological differences introduce some deviations from perfect competition, they serve as a reasonable approximation.

-

Online Marketplaces for Standardized Goods: Online platforms that facilitate the sale of standardized goods, like certain electronics or clothing items from numerous sellers, can approximate perfect competition. The large number of sellers and relatively easy entry and exit contribute to this resemblance. However, brand recognition and differences in shipping costs can introduce complexities.

-

Stock Market (In Certain Aspects): The stock market, particularly for widely traded stocks, can exhibit elements of perfect competition. Many buyers and sellers transact, and information is generally readily available. However, information asymmetry and the presence of large institutional investors introduce deviations from the model.

Conclusion: Mastering Perfect Competition in AP Economics

Understanding perfect competition is crucial for succeeding in your AP Economics course. This chapter lays the foundation for understanding more complex market structures and broader economic concepts. By grasping the defining characteristics, implications, and equilibrium conditions of perfect competition, you'll be well-equipped to analyze market behavior and ace your quizzes and exams. Remember, while perfect competition is a theoretical model, it serves as a valuable tool for understanding the forces of supply and demand and the role of competition in driving efficiency in the economy. Keep practicing, and you'll master this important topic!

Latest Posts

Latest Posts

-

One Source Of Lead On Some Job Sites Is

Mar 17, 2025

-

When Responding To Litigation Holds Foia Requests Investigations Or Inquiries

Mar 17, 2025

-

Participant Motivation Is Usually The Result Of

Mar 17, 2025

-

All Flags Such As Porn And Upsetting Offensive Are Query Independent

Mar 17, 2025

-

An Electrical Motor Provides 0 50 W Of Mechanical Power

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Chapter 23 Perfect Competition Ap Econ Quizlet Mcconnell Brue . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.