The Capital Expenditures Budget Reports Expected:

Onlines

Mar 15, 2025 · 6 min read

Table of Contents

Capital Expenditures Budget Reports: A Comprehensive Guide

Capital expenditures (CapEx) are investments a company makes to acquire or upgrade physical assets, such as property, plant, and equipment (PP&E). Effective CapEx budgeting and reporting are crucial for the financial health and long-term success of any organization. This comprehensive guide delves into the expectations surrounding CapEx budget reports, covering everything from their purpose and components to best practices and potential pitfalls.

The Purpose of Capital Expenditures Budget Reports

CapEx budget reports serve several vital purposes:

-

Strategic Alignment: They ensure that spending aligns with the company's overall strategic objectives and long-term goals. By carefully evaluating proposed projects against strategic priorities, companies can maximize return on investment (ROI) and avoid wasteful spending.

-

Financial Planning and Control: These reports provide a crucial tool for financial planning and control. They enable management to monitor actual spending against the budget, identify variances, and take corrective action as needed. This proactive approach is essential for preventing budget overruns and ensuring that projects remain on track.

-

Resource Allocation: Effective CapEx reporting facilitates efficient resource allocation. By prioritizing projects based on their potential impact and ROI, companies can optimize the use of their limited financial resources.

-

Decision-Making: CapEx reports provide essential information for informed decision-making. By analyzing the financial performance of past projects and forecasting the potential outcomes of future investments, companies can make well-informed choices about which projects to undertake and which to reject.

-

Transparency and Accountability: Comprehensive CapEx reporting promotes transparency and accountability within the organization. By making the budget and actual spending data readily available to relevant stakeholders, companies can ensure that everyone understands the company's investment strategy and is accountable for their role in its execution.

-

Investor Relations: For publicly traded companies, CapEx reports are vital for investor relations. These reports provide insights into the company's investment plans and financial health, which are crucial factors for investors when making investment decisions.

Key Components of a Comprehensive CapEx Budget Report

A well-structured CapEx budget report should include the following key components:

-

Executive Summary: A concise overview of the report's key findings and recommendations. This section should highlight the most important aspects of the CapEx budget, including total planned expenditure, key projects, and anticipated ROI.

-

Budget Overview: A detailed breakdown of the total CapEx budget, showing planned expenditures by project, department, or other relevant categories. This section should also include a clear explanation of the methodology used to develop the budget.

-

Project Details: Individual project descriptions, including the project's objectives, scope, timeline, budget, and anticipated ROI. This section should provide sufficient detail to allow stakeholders to understand each project's purpose and potential impact. It might include supporting documents such as feasibility studies or project proposals.

-

Actual vs. Budget Comparison: A comparison of actual spending against the budgeted amount for each project. This section should highlight any significant variances and provide explanations for any overruns or underspends.

-

Variance Analysis: An in-depth analysis of any significant variances between actual and budgeted amounts. This analysis should identify the root causes of the variances and propose corrective actions to prevent similar problems in the future. This could involve assessing unforeseen circumstances or project inefficiencies.

-

Forecasted CapEx: A projection of future CapEx requirements, based on the company's strategic plans and anticipated growth. This section is vital for long-term financial planning.

-

Risk Assessment: An assessment of the potential risks associated with the CapEx budget, including financial risks, operational risks, and regulatory risks. This section should outline potential mitigation strategies.

-

Return on Investment (ROI) Analysis: An analysis of the expected ROI for each project. This section should clearly demonstrate the financial benefits of each investment.

-

Key Performance Indicators (KPIs): Relevant KPIs that track the progress and success of CapEx projects. Examples include project completion rates, cost overruns, and ROI.

-

Appendix: Supporting documentation, such as project proposals, feasibility studies, and detailed financial statements.

Best Practices for CapEx Budget Reporting

-

Regular Reporting: CapEx budget reports should be prepared and distributed regularly, ideally on a monthly or quarterly basis. This allows for timely identification and resolution of any issues.

-

Data Accuracy and Consistency: It's crucial to ensure the accuracy and consistency of the data used in the reports. Data should be gathered from reliable sources and validated before being included in the report.

-

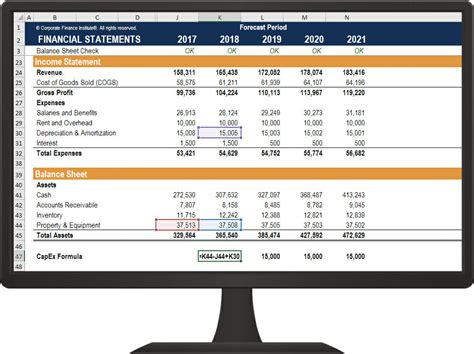

Clear and Concise Communication: The report should be written in clear and concise language, avoiding technical jargon that may be difficult for non-financial stakeholders to understand. Visual aids, such as charts and graphs, can significantly enhance understanding.

-

Collaboration and Transparency: The budgeting process should involve collaboration among different departments and stakeholders. Transparency is crucial to ensure buy-in and accountability.

-

Use of Technology: Utilize budgeting software and other technologies to streamline the budgeting process and improve the accuracy and efficiency of reporting. This can significantly reduce manual effort and enhance data analysis.

-

Continuous Improvement: Regularly review and improve the CapEx budgeting and reporting process based on lessons learned and feedback from stakeholders. This iterative approach will lead to more accurate and effective budgeting over time.

Potential Pitfalls to Avoid

-

Inaccurate Forecasting: Inaccurate forecasts can lead to significant budget overruns or underspends. It's crucial to use reliable data and appropriate forecasting techniques.

-

Lack of Transparency: A lack of transparency can lead to mistrust and a lack of accountability. Open communication is essential for effective CapEx management.

-

Poor Communication: Poor communication can lead to misunderstandings and delays. Clear and concise communication is vital for ensuring that everyone is on the same page.

-

Ignoring Risks: Ignoring potential risks can lead to significant problems later on. A thorough risk assessment is essential for effective CapEx management.

-

Insufficient Data Analysis: Insufficient data analysis can lead to poor decision-making. Detailed analysis is crucial for understanding the performance of CapEx projects.

-

Lack of Flexibility: A rigid CapEx budget may not be able to adapt to changing circumstances. Flexibility is essential to allow for adjustments as needed.

Advanced Techniques for CapEx Budget Reporting

-

Scenario Planning: Develop multiple budget scenarios to account for different economic conditions and market uncertainties. This enables more robust decision-making.

-

Sensitivity Analysis: Analyze the impact of changes in key assumptions (e.g., project costs, revenue projections) on the overall CapEx budget. This allows for understanding the potential impact of unforeseen circumstances.

-

Data Visualization: Use dashboards and other visualization tools to present CapEx data in a clear, concise, and easily understandable manner.

-

Predictive Analytics: Employ advanced analytics techniques to forecast future CapEx requirements and identify potential risks or opportunities.

-

Integration with Enterprise Resource Planning (ERP) Systems: Integrate CapEx budget data with ERP systems to improve data accuracy and consistency and streamline reporting.

Conclusion

Effective CapEx budget reporting is essential for the financial health and long-term success of any organization. By following best practices, avoiding common pitfalls, and leveraging advanced techniques, companies can ensure that their CapEx investments are aligned with their strategic objectives, are well-managed, and deliver maximum return on investment. Regular monitoring, proactive variance analysis, and a commitment to continuous improvement are key to the success of any CapEx program. The information presented in this comprehensive guide provides a solid foundation for developing robust and effective CapEx budget reporting processes. By understanding the purpose, components, and best practices, organizations can optimize their capital investment strategies and build a stronger financial future.

Latest Posts

Latest Posts

-

Participant Motivation Is Usually The Result Of

Mar 17, 2025

-

All Flags Such As Porn And Upsetting Offensive Are Query Independent

Mar 17, 2025

-

An Electrical Motor Provides 0 50 W Of Mechanical Power

Mar 17, 2025

-

Studying Marketing Should Help You To Blank

Mar 17, 2025

-

Shaping Clay On A Rapidly Turning Wheel Is Called

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Capital Expenditures Budget Reports Expected: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.