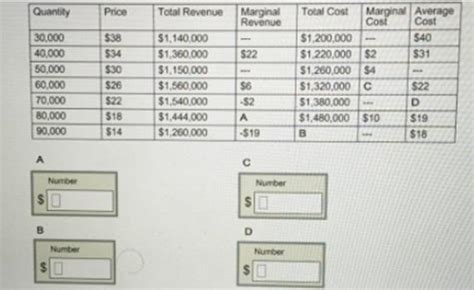

The Table Shows The Costs And Revenue For Glitter Ltd

Onlines

Mar 17, 2025 · 6 min read

Table of Contents

Glitter Ltd: A Deep Dive into Costs, Revenue, and Profitability

The following analysis delves into the financial performance of Glitter Ltd, examining its costs and revenue streams to assess its profitability and identify areas for potential improvement. While a specific table of costs and revenue is absent, this article will construct hypothetical scenarios based on common cost structures and revenue models within a company like Glitter Ltd, which we'll assume operates in the manufacturing and/or retail of glitter-related products. This allows for a comprehensive exploration of financial analysis applicable to any business facing similar challenges.

This analysis will cover key aspects of Glitter Ltd's financial health, including:

- Cost of Goods Sold (COGS): Detailing the direct costs associated with producing glitter products.

- Operating Expenses: Exploring indirect costs such as marketing, sales, and administration.

- Revenue Analysis: Examining the various revenue streams and identifying key performance indicators (KPIs).

- Profitability Analysis: Calculating gross profit, operating profit, and net profit margins to gauge overall financial health.

- Break-Even Analysis: Determining the sales volume required to cover all costs.

- Scenario Planning: Exploring potential impacts of changes in costs and revenue.

Cost of Goods Sold (COGS) for Glitter Ltd

COGS represents the direct costs incurred in producing Glitter Ltd's products. This includes:

Raw Materials:

- Glitter Powder: The core ingredient; cost will vary based on type, quality, and supplier. Fluctuations in raw material prices (e.g., mica, polyester) significantly impact COGS. Efficient procurement strategies are crucial for minimizing this cost.

- Packaging Materials: Bottles, jars, tubes, labels, and any other packaging components. Sourcing cost-effective materials without sacrificing quality is vital. Negotiating bulk discounts with suppliers is an important cost-saving measure.

- Additives and Chemicals: Any binding agents, pigments, or other additives used in the glitter manufacturing process. The cost here depends on the complexity and quality of the final product.

Direct Labor:

- Production Workers: Wages and benefits paid to employees directly involved in manufacturing glitter products. Optimizing production processes and investing in automation can improve efficiency and reduce labor costs.

- Quality Control: Costs related to ensuring consistent quality and preventing defects. Implementing robust quality control procedures minimizes waste and rework, saving money in the long run.

Manufacturing Overhead:

- Factory Rent and Utilities: Costs associated with the manufacturing facility. Negotiating favorable lease terms and implementing energy-efficient practices can help reduce these costs.

- Equipment Depreciation: The cost of wear and tear on manufacturing equipment. Regular maintenance and strategic equipment upgrades can extend equipment lifespan and minimize depreciation.

Operating Expenses for Glitter Ltd

Operating expenses encompass indirect costs necessary for running the business:

Marketing and Sales:

- Advertising and Promotion: Costs related to marketing campaigns, both online and offline. Effective digital marketing strategies and targeted advertising can maximize return on investment (ROI).

- Sales Commissions: Payments to sales representatives based on sales performance. Implementing a well-structured sales compensation plan can motivate sales teams and improve sales revenue.

- Trade Shows and Events: Costs related to participating in industry trade shows and events. Careful selection of events that align with Glitter Ltd's target market can maximize impact and ROI.

General and Administrative Expenses:

- Salaries: Wages and benefits for administrative staff (e.g., accounting, human resources, management). Optimizing staffing levels and investing in employee training improve productivity and reduce overall costs.

- Rent and Utilities: Costs associated with office space. Exploring flexible work arrangements (e.g., remote work) can reduce office space needs.

- Insurance: Costs for property, liability, and other insurance policies. Shopping around for competitive insurance rates can save money.

- Legal and Professional Fees: Costs associated with legal advice, accounting services, and other professional fees. Maintaining strong relationships with trusted professionals and negotiating favorable fees can save costs.

Revenue Analysis for Glitter Ltd

Glitter Ltd's revenue is primarily generated from sales of its glitter products. However, multiple revenue streams are possible:

Product Sales:

- Wholesale Sales: Selling bulk quantities of glitter to retailers and distributors. Building strong relationships with key distributors can increase sales volume and market reach.

- Retail Sales: Selling glitter directly to consumers through online channels (e.g., e-commerce website) or physical stores. Optimizing website design and user experience for online sales is crucial. Creating an appealing in-store experience drives sales in physical locations.

- Custom Orders: Offering customized glitter blends or packaging to meet specific customer requirements. Efficient production processes and effective communication with clients are key to fulfilling custom orders successfully.

Other Revenue Streams:

- Private Labeling: Partnering with other companies to manufacture and package glitter under their brand names. This expands revenue opportunities and leverages Glitter Ltd's manufacturing capabilities.

- Subscription Boxes: Offering curated glitter subscription boxes for regular deliveries to loyal customers. Building a strong brand identity and offering excellent customer service is crucial for subscription box success.

Profitability Analysis for Glitter Ltd

Analyzing profitability requires calculating various profit margins:

Gross Profit Margin:

This is calculated as (Revenue - COGS) / Revenue. A higher gross profit margin indicates efficient cost management and strong pricing strategies.

Operating Profit Margin:

Calculated as (Revenue - COGS - Operating Expenses) / Revenue. This shows profitability after deducting all operating costs.

Net Profit Margin:

Calculated as (Net Income / Revenue). This reflects overall profitability after all expenses, including taxes and interest, are accounted for.

Break-Even Analysis for Glitter Ltd

The break-even point is the sales volume at which revenue equals total costs (COGS + Operating Expenses). This analysis helps determine the minimum sales necessary for profitability. The formula is:

Break-Even Point (units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

Scenario Planning for Glitter Ltd

Scenario planning involves developing different financial projections based on varying assumptions. For example:

- Scenario 1: Increase in Raw Material Costs: This would require Glitter Ltd to assess its pricing strategies, explore alternative suppliers, or find ways to reduce consumption of raw materials.

- Scenario 2: Increased Competition: Glitter Ltd might need to improve its marketing efforts, introduce innovative products, or focus on a specific niche market.

- Scenario 3: Expansion into New Markets: This requires a careful assessment of market demand, competitive landscape, and associated costs.

Key Performance Indicators (KPIs) for Glitter Ltd

Regular monitoring of KPIs is essential for effective management and decision-making. Important KPIs for Glitter Ltd include:

- Revenue Growth: Tracking the increase or decrease in revenue over time.

- Gross Profit Margin: Monitoring the efficiency of cost management.

- Operating Profit Margin: Assessing overall profitability after operating expenses.

- Net Profit Margin: Evaluating overall profitability after all expenses.

- Customer Acquisition Cost (CAC): Measuring the cost of acquiring new customers.

- Customer Lifetime Value (CLTV): Assessing the long-term revenue generated by a customer.

- Inventory Turnover: Measuring how efficiently inventory is managed.

Conclusion

A thorough understanding of Glitter Ltd's costs, revenue streams, and profitability is essential for its long-term success. By continuously monitoring KPIs, performing regular financial analysis, and developing proactive strategies to manage costs and increase revenue, Glitter Ltd can ensure sustained growth and profitability in a competitive market. The hypothetical scenarios presented in this article demonstrate the importance of adaptability and strategic planning in the face of changing market conditions. Regular financial review and proactive management are key to navigating the challenges and opportunities inherent in running a successful business.

Latest Posts

Latest Posts

-

When Responding To Litigation Holds Foia Requests Investigations Or Inquiries

Mar 17, 2025

-

Participant Motivation Is Usually The Result Of

Mar 17, 2025

-

All Flags Such As Porn And Upsetting Offensive Are Query Independent

Mar 17, 2025

-

An Electrical Motor Provides 0 50 W Of Mechanical Power

Mar 17, 2025

-

Studying Marketing Should Help You To Blank

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Table Shows The Costs And Revenue For Glitter Ltd . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.