Suppose The Graph Depicts A Hypothetical Market

Onlines

Mar 30, 2025 · 6 min read

Table of Contents

Decoding the Hypothetical Market: A Deep Dive into Graph Analysis

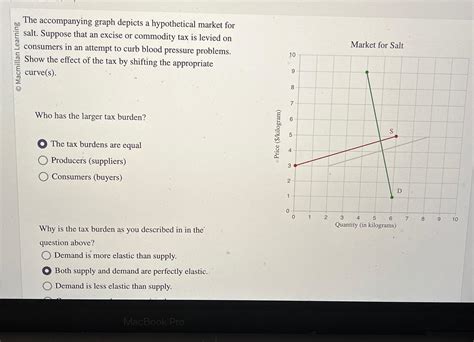

Suppose the graph depicts a hypothetical market. This statement immediately opens a vast landscape of possibilities. Understanding the nuances of this hypothetical market requires a detailed analysis of the graph itself, including its axes, data points, trends, and any additional information provided. This article explores various interpretations of such a hypothetical market graph, focusing on common market representations and analytical approaches. We will delve into the significance of different graph types, exploring their strengths and limitations in depicting market dynamics. We will also touch upon the implications for various stakeholders, including producers, consumers, and regulators.

Understanding the Variables: Defining the Axes

The first step in analyzing any market graph is understanding the variables represented on the x and y axes. Common representations include:

-

Price vs. Quantity: This is the most common representation, showing the relationship between the price of a good or service and the quantity demanded or supplied. A downward-sloping demand curve indicates that as price decreases, quantity demanded increases, and vice-versa. An upward-sloping supply curve reflects the fact that as price increases, quantity supplied increases. The point where supply and demand intersect determines the market equilibrium price and quantity.

-

Price vs. Time: This graph displays price fluctuations over time. It is useful for identifying trends, such as upward trends (bull markets), downward trends (bear markets), and periods of volatility. This representation is vital for understanding market sentiment and predicting future price movements. Technical analysis heavily relies on this type of graph.

-

Quantity vs. Time: This type of graph shows the changes in quantity traded over time. This is particularly useful for understanding market volume, which can provide insights into market strength and investor confidence. High volume often accompanies significant price movements, indicating strong conviction in the market direction.

-

Price vs. Other Economic Indicators: A graph could plot price against macroeconomic indicators like inflation, interest rates, or GDP growth. This reveals correlations between the market and the broader economy. For example, a positive correlation between price and inflation might indicate that the market is sensitive to inflationary pressures.

Interpreting the Graph: Types of Markets and Their Representations

The shape and characteristics of the graph reveal crucial information about the type of market being depicted. We can identify several common market structures through graphical representation:

-

Perfect Competition: This theoretical market structure is characterized by a large number of buyers and sellers, homogeneous products, free entry and exit, and perfect information. In a graph showing price vs. quantity, the supply and demand curves intersect at a single point, representing the equilibrium price and quantity. The individual firm's supply curve is perfectly elastic (horizontal) at the market price.

-

Monopoly: In a monopoly, a single seller controls the entire market. The monopolist has significant market power and can influence the price. The graph typically shows a downward-sloping demand curve and a marginal revenue curve that lies below the demand curve. The monopolist will produce at a quantity where marginal revenue equals marginal cost, resulting in a higher price and lower quantity than under perfect competition.

-

Oligopoly: An oligopoly is characterized by a few dominant firms controlling a significant portion of the market. The behavior of these firms is interdependent, leading to strategic interactions. Graphical representation may show kinked demand curves, reflecting the rigidity of prices within a certain range.

-

Monopolistic Competition: This market structure combines elements of both perfect competition and monopoly. There are many sellers, but each offers a slightly differentiated product. The graph shows downward-sloping demand curves, but they are less steep than in a monopoly, reflecting the availability of substitutes.

Analyzing the Data: Trends and Patterns

Once the variables and market structure are understood, the next step is to analyze the data points and identify trends and patterns:

-

Identifying Trends: Look for upward or downward trends in the data. An upward trend suggests increasing demand or supply, while a downward trend indicates the opposite. The slope of the trend line can provide information on the rate of change.

-

Identifying Volatility: Analyze the variability of the data. High volatility suggests a fluctuating market, potentially driven by unpredictable events or investor sentiment. Low volatility indicates a more stable market.

-

Identifying Turning Points: These are points where the trend changes direction. Identifying turning points can be crucial for making investment decisions or for understanding shifts in market dynamics.

-

Correlation Analysis: If the graph plots price against another variable (e.g., inflation), a correlation analysis can reveal the relationship between them. A positive correlation indicates that both variables move in the same direction, while a negative correlation suggests they move in opposite directions.

Implications for Stakeholders: Producers, Consumers, and Regulators

The hypothetical market depicted in the graph has implications for various stakeholders:

-

Producers: The graph helps producers understand market demand, price elasticity, and competition. This information is vital for pricing strategies, production decisions, and overall business planning. A high demand curve indicates potential for higher profits, while a low demand curve might necessitate cost-cutting measures or product diversification.

-

Consumers: The graph helps consumers understand the price of goods and services, as well as their availability. This enables informed purchasing decisions and the ability to compare prices and product offerings from different producers. A steep demand curve indicates price sensitivity, while a flat curve suggests less price sensitivity.

-

Regulators: The graph helps regulators monitor market conditions, identify potential monopolies or anti-competitive behavior, and implement policies to promote fair competition and consumer welfare. Regulators use this data to assess market efficiency and intervene when necessary to address market failures.

Limitations of Graphical Representation

While graphs are powerful tools for visualizing market data, they also have limitations:

-

Simplification: Graphs simplify complex market dynamics. They may not capture all relevant factors influencing market behavior.

-

Data Selection Bias: The selection of data can influence the interpretation of the graph. Data manipulation or the omission of relevant information can lead to misleading conclusions.

-

Causation vs. Correlation: Correlation does not imply causation. A graph may show a correlation between two variables, but this does not necessarily mean that one variable causes the other.

-

Predictive Limitations: While graphs can reveal trends and patterns, they are not perfect predictors of future market behavior. Unexpected events or shifts in market sentiment can lead to deviations from predicted outcomes.

Conclusion: Unraveling the Hypothetical Market

Analyzing a hypothetical market graph requires a systematic approach, starting with understanding the variables, identifying the market structure, and analyzing the data points for trends and patterns. This information is crucial for producers, consumers, and regulators to understand market dynamics and make informed decisions. However, it is essential to acknowledge the limitations of graphical representations and to consider additional factors that might influence market behavior beyond what is visually presented in the graph. Remember to always approach the analysis critically, considering potential biases and limitations before drawing conclusions about the hypothetical market depicted. By critically evaluating the data and considering various perspectives, we can gain a comprehensive understanding of the complex relationships within a hypothetical market.

Latest Posts

Latest Posts

-

A Block Initially At Rest Is Given A Quick Push

Apr 01, 2025

-

Ms Jensen Has Heard About Original

Apr 01, 2025

-

Experiment 13 The Geometrical Structure Of Molecules Answers

Apr 01, 2025

-

You Completed Your Ati Capstone Assessment And Want To Contact

Apr 01, 2025

-

Paralytic Medications Exert Their Effect By

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Suppose The Graph Depicts A Hypothetical Market . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.